QuickZoll

Bundesamt fur Zoll und Grenzsicherheit BAZG

3.0 ★

store rating

Free

AppRecs review analysis

AppRecs rating 2.8. Trustworthiness 80 out of 100. Review manipulation risk 20 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.8

AppRecs Rating

Ratings breakdown

5 star

33%

4 star

0%

3 star

0%

2 star

33%

1 star

33%

What to know

✓

Low review manipulation risk

20% review manipulation risk

✓

Credible reviews

80% trustworthiness score from analyzed reviews

About QuickZoll

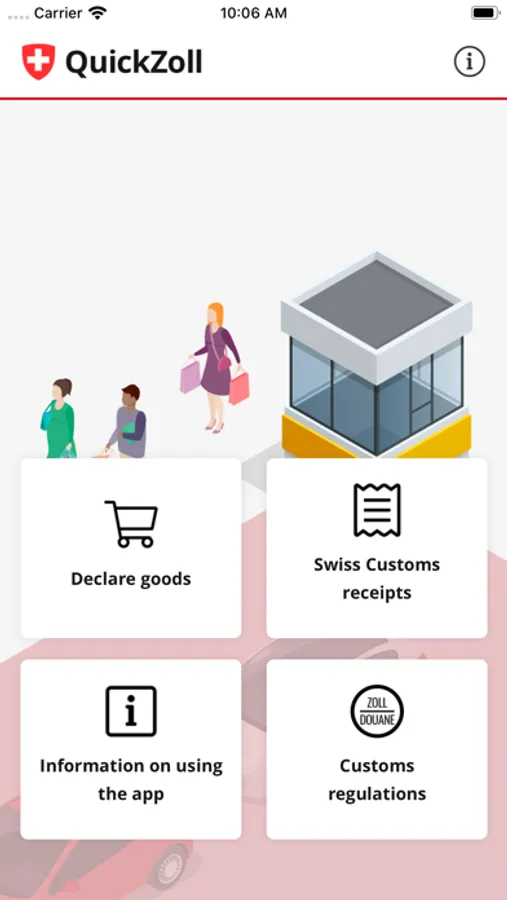

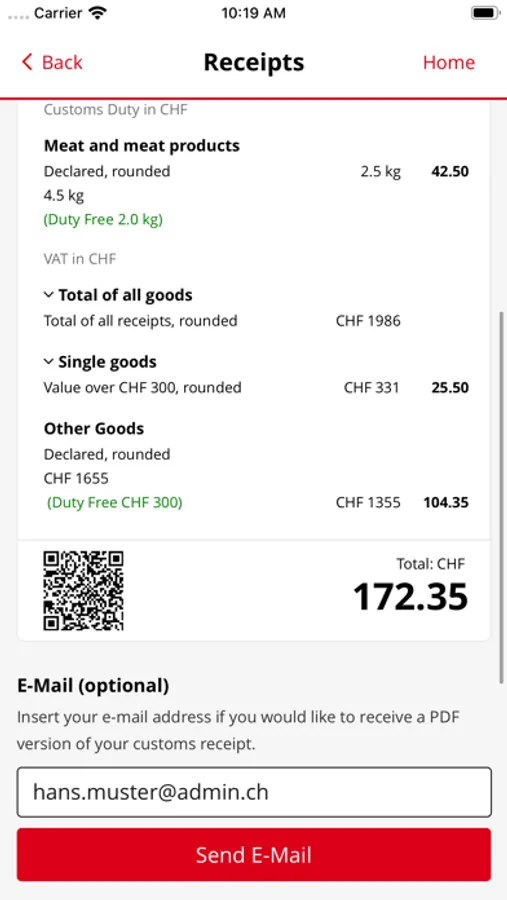

Enjoy a calm return from your voyage with QuickZoll. Swiss Customs' official app lets you declare the import of goods intended for your private use or as gifts. Pay the duty autonomously and directly from your smartphone and cross the border without waiting at the counter.

The advantages of QuickZoll

- Simple and swift declaration without preregistration

- Secure payment by TWINT or credit card

- Cross the border without stopping at the counter, 24 hours a day, 7 days a week

- Useful information on entering Switzerland is available directly in the app

When is it better to use QuickZoll?

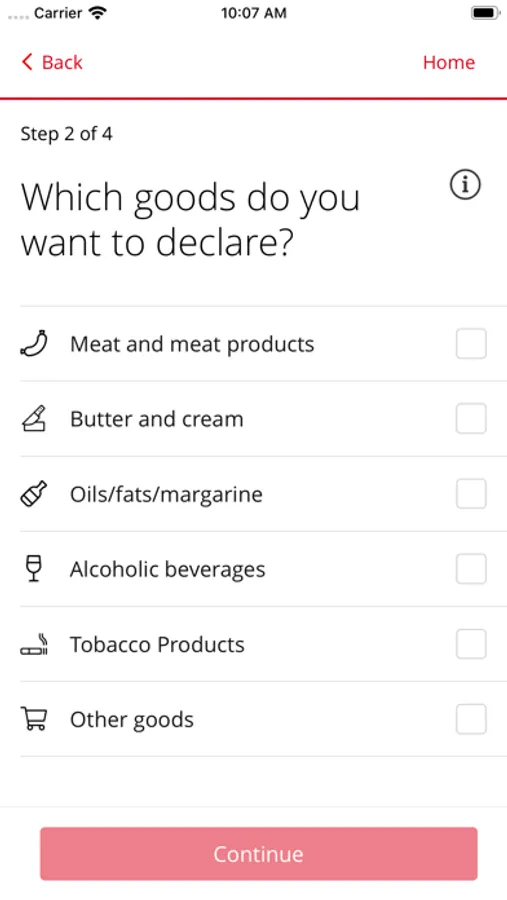

QuickZoll is the ideal solution for goods taxed at the normal VAT rate (8.1%):

- Clothes, shoes

- Electronics, accessories

- Cosmetics, perfume

- Wines, spirits

- Watches, jewellery

- Furniture, garden furniture, outdoor items

- Cigarettes, tobacco

Note: For products taxed at the reduced VAT rate (2.6%) such as food, books or medicines, it might be better to make a verbal or written declaration.

The advantages of QuickZoll

- Simple and swift declaration without preregistration

- Secure payment by TWINT or credit card

- Cross the border without stopping at the counter, 24 hours a day, 7 days a week

- Useful information on entering Switzerland is available directly in the app

When is it better to use QuickZoll?

QuickZoll is the ideal solution for goods taxed at the normal VAT rate (8.1%):

- Clothes, shoes

- Electronics, accessories

- Cosmetics, perfume

- Wines, spirits

- Watches, jewellery

- Furniture, garden furniture, outdoor items

- Cigarettes, tobacco

Note: For products taxed at the reduced VAT rate (2.6%) such as food, books or medicines, it might be better to make a verbal or written declaration.