With this financing app, you can apply for equipment loans, manage funding requests, and access instant credit decisions. Includes digital documentation, real-time status updates, and in-app servicing tools.

AppRecs review analysis

AppRecs rating 4.7. Trustworthiness 75 out of 100. Review manipulation risk 26 out of 100. Based on a review sample analyzed.

★★★★☆

4.7

AppRecs Rating

Ratings breakdown

5 star

86%

4 star

9%

3 star

2%

2 star

0%

1 star

4%

What to know

✓

Low review manipulation risk

26% review manipulation risk

✓

Credible reviews

75% trustworthiness score from analyzed reviews

✓

High user satisfaction

86% of sampled ratings are 5 stars

About QuickFi

QuickFi serves several of the world’s largest global construction and industrial equipment manufacturers (OEMs) with nearly instant business equipment financing available 24/7 at the point of sale (throughout the US and Canada) on the borrower’s mobile device.

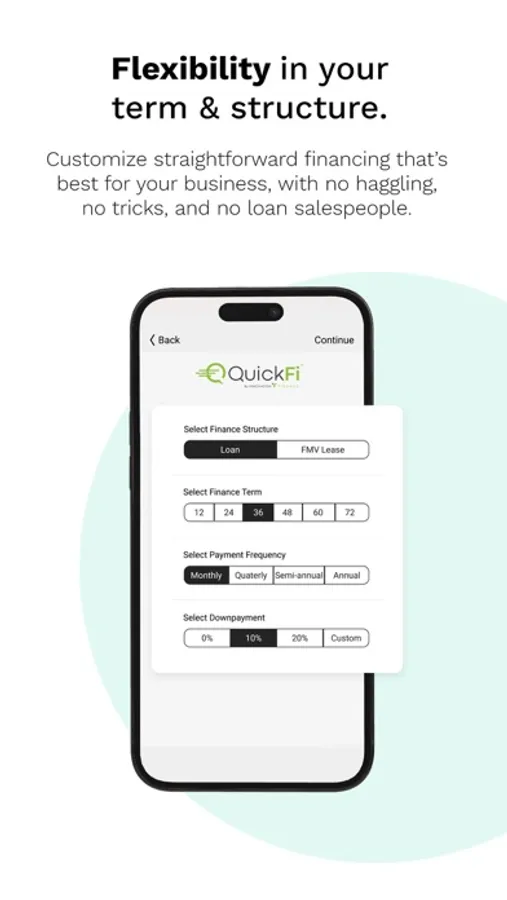

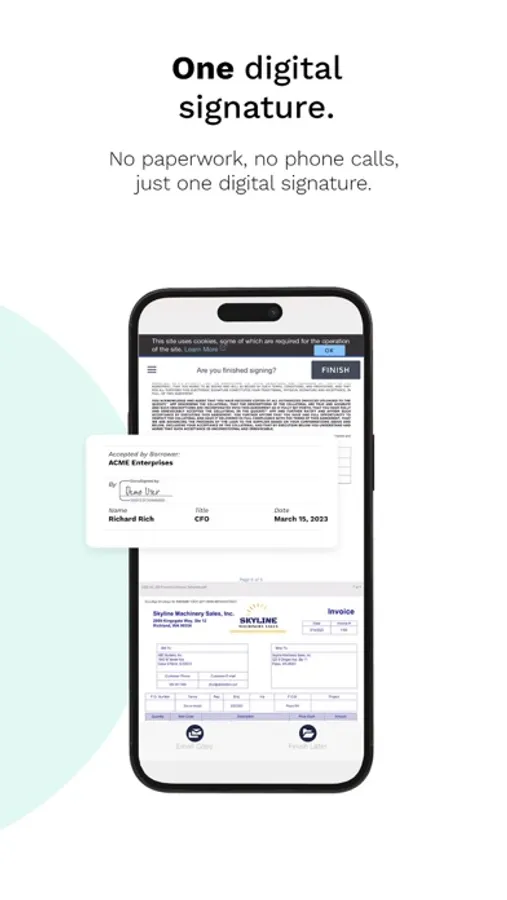

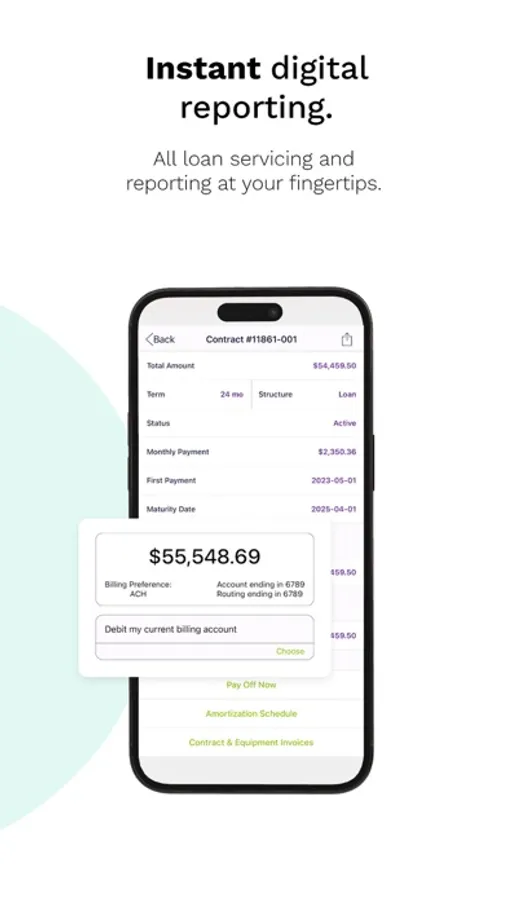

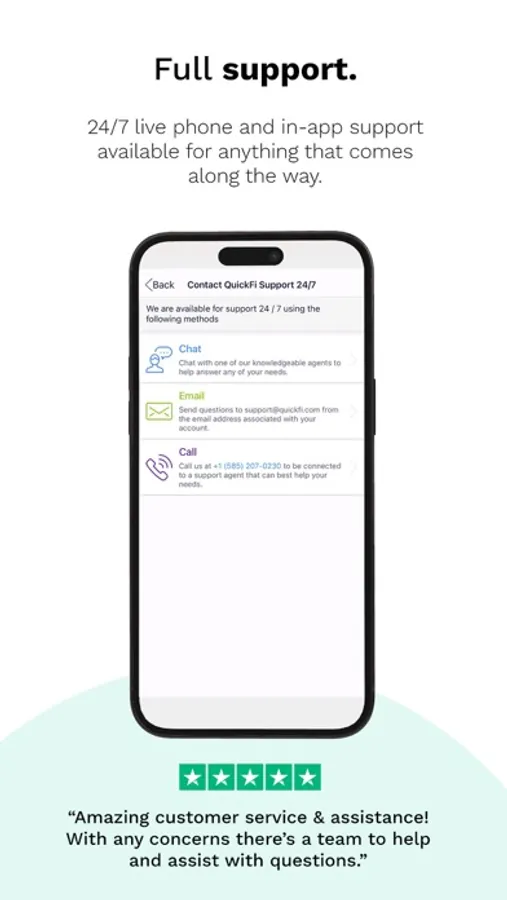

Small and medium business borrowers (SMBs) can instantly apply for up to $500,000 in bank or manufacturer financing with nearly instant credit processing, digital documentation, same-day or next-day funding, and in-app servicing.

Using patented embedded lending and AI agent technology, QuickFi’s revolutionary platform is revolutionizing the $1.34 trillion per year US business equipment financing market.

QuickFi costs banks and manufacturers less than 1/3 the cost of operating a traditional vendor financing program.

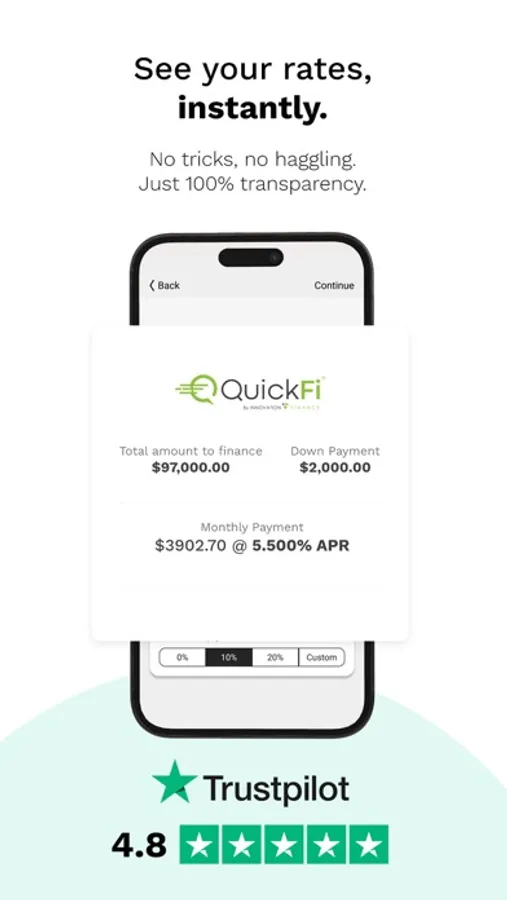

Because of its speed, transparency, and borrower convenience, SMB borrowers love QuickFi. QuickFi TrustPilot ratings are 4.8 (on a 5.0 scale). QuickFi is expanding its program offerings to include medical, office, technology, and agricultural business equipment financing.

Contact QuickFi today to establish a digital captive financing program: info@quickfi.com

Small and medium business borrowers (SMBs) can instantly apply for up to $500,000 in bank or manufacturer financing with nearly instant credit processing, digital documentation, same-day or next-day funding, and in-app servicing.

Using patented embedded lending and AI agent technology, QuickFi’s revolutionary platform is revolutionizing the $1.34 trillion per year US business equipment financing market.

QuickFi costs banks and manufacturers less than 1/3 the cost of operating a traditional vendor financing program.

Because of its speed, transparency, and borrower convenience, SMB borrowers love QuickFi. QuickFi TrustPilot ratings are 4.8 (on a 5.0 scale). QuickFi is expanding its program offerings to include medical, office, technology, and agricultural business equipment financing.

Contact QuickFi today to establish a digital captive financing program: info@quickfi.com