In this personal finance app, you can create and manage your monthly budget using the 50/30/20 rule and track expenses. Includes income tracking, expense categorization, and savings goal management.

AppRecs review analysis

AppRecs rating 4.7. Trustworthiness 70 out of 100. Review manipulation risk 24 out of 100. Based on a review sample analyzed.

★★★★☆

4.7

AppRecs Rating

Ratings breakdown

5 star

84%

4 star

9%

3 star

6%

2 star

0%

1 star

2%

What to know

✓

Low review manipulation risk

24% review manipulation risk

✓

Credible reviews

70% trustworthiness score from analyzed reviews

✓

High user satisfaction

84% of sampled ratings are 5 stars

About Budget Planner App・50/30/20

Your All-in-One Budget Planner and Bill Tracker for Smart Money Management. It is now easy to reach financial freedom with a 50/30/20 Personal Capital Planner.

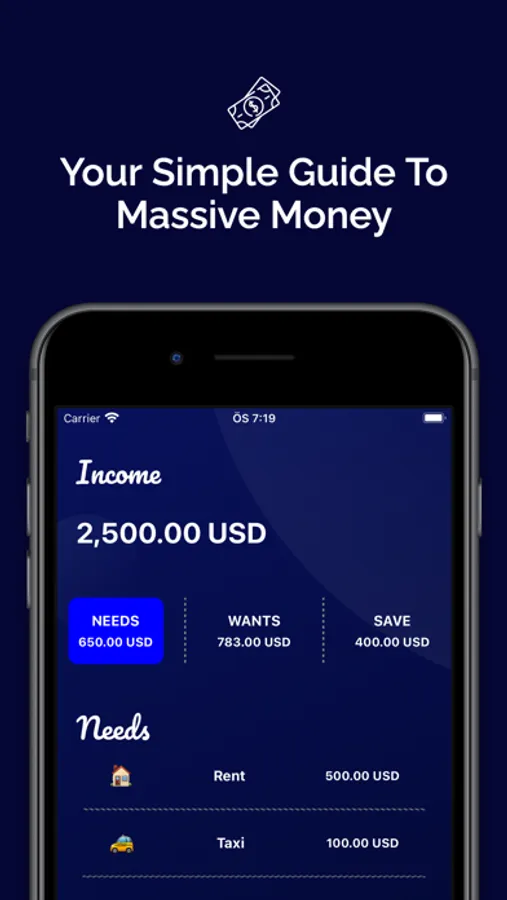

Utilize a monthly budget planner to create and manage your budget effectively each month.

• Keep track of all your income

• The best way to split your income using the 50/30/20 rule

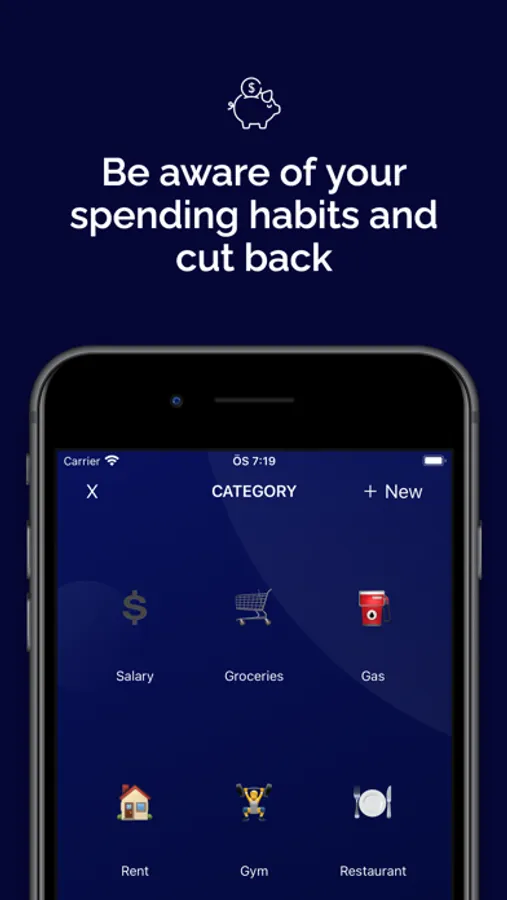

• Be aware of your budgeting and spending habits and cut back

FINANCIAL NEEDS

Your needs are:

• Utilities

• Housing

• Transportation

• Food, water and clothes

The app helps you to keep your needs at 50% of your total net income.

FINANCIAL WANTS

Your wants are:

• Clothing that isn't essential

• Dining out or ordering takeout

• Hobbies, traveling, large house, and new expensive car

The app helps you to budget your wants within 30% of your monthly net income.

SAVINGS

Pay yourself every month towards:

• Retirement or long-term savings

• Short-term savings for a new car or vacation

• Emergency funds of 6-12 months of living expenses

Put 10% of your net income towards savings each month.

*** Key Features ***

* Free Budget Tracker:

Effortlessly track your budget with our free and user-friendly app.

* Personal Finance Insights:

Gain valuable insights into your personal finance for informed decision-making.

* Money Saving:

Achieve your savings goals with smart money-saving features and tips.

* Financial Planner Monitoring:

Let our financial planner monitor and optimize your budget using the 50/30/20 rule.

* Expense Monitoring and Keeping:

Easily record and categorize expenses for a clear overview of your spending.

Utilize a monthly budget planner to create and manage your budget effectively each month.

• Keep track of all your income

• The best way to split your income using the 50/30/20 rule

• Be aware of your budgeting and spending habits and cut back

FINANCIAL NEEDS

Your needs are:

• Utilities

• Housing

• Transportation

• Food, water and clothes

The app helps you to keep your needs at 50% of your total net income.

FINANCIAL WANTS

Your wants are:

• Clothing that isn't essential

• Dining out or ordering takeout

• Hobbies, traveling, large house, and new expensive car

The app helps you to budget your wants within 30% of your monthly net income.

SAVINGS

Pay yourself every month towards:

• Retirement or long-term savings

• Short-term savings for a new car or vacation

• Emergency funds of 6-12 months of living expenses

Put 10% of your net income towards savings each month.

*** Key Features ***

* Free Budget Tracker:

Effortlessly track your budget with our free and user-friendly app.

* Personal Finance Insights:

Gain valuable insights into your personal finance for informed decision-making.

* Money Saving:

Achieve your savings goals with smart money-saving features and tips.

* Financial Planner Monitoring:

Let our financial planner monitor and optimize your budget using the 50/30/20 rule.

* Expense Monitoring and Keeping:

Easily record and categorize expenses for a clear overview of your spending.