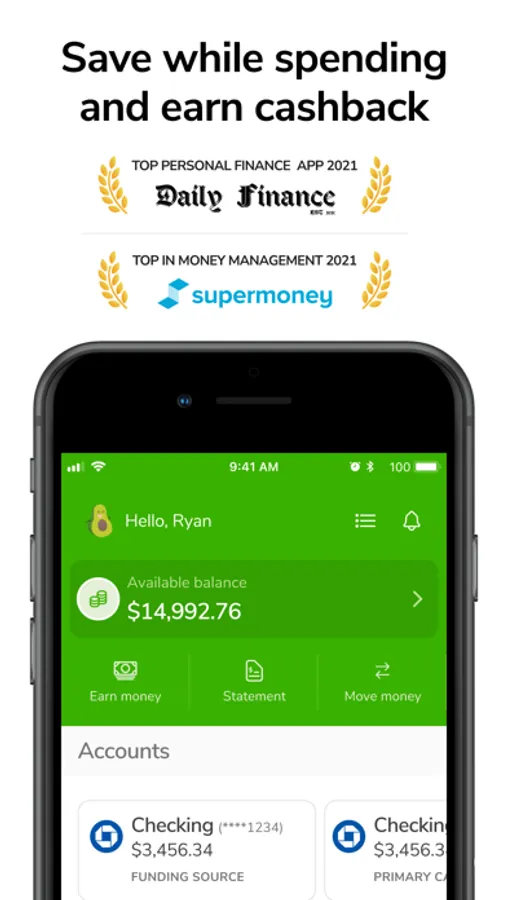

Guac - Save While You Spend

New World Savings, Inc

4.4 ★

store rating

Free

With this financial app, you can link your bank account, set savings goals, and automate funds transfer. Includes transaction synchronization, goal setting, and cash back rewards.

AppRecs review analysis

AppRecs rating 4.5. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.5

AppRecs Rating

Ratings breakdown

5 star

79%

4 star

5%

3 star

2%

2 star

2%

1 star

12%

What to know

✓

High user satisfaction

84% of sampled ratings are 4+ stars (4.4★ average)

✓

Detailed user feedback

44% of sampled reviews provide substantial detail

About Guac - Save While You Spend

Saving Money with Guac in 4 Easy Steps

1. Sync Guac with Your Bank

Securely connect your bank checking account to synchronize your transactions. Guac makes saving simple and automatic — all within a secure environment you can trust.

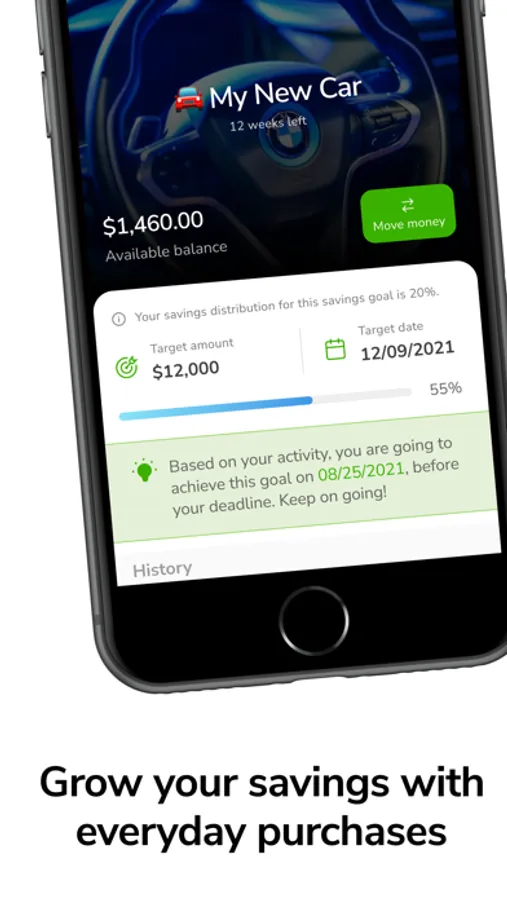

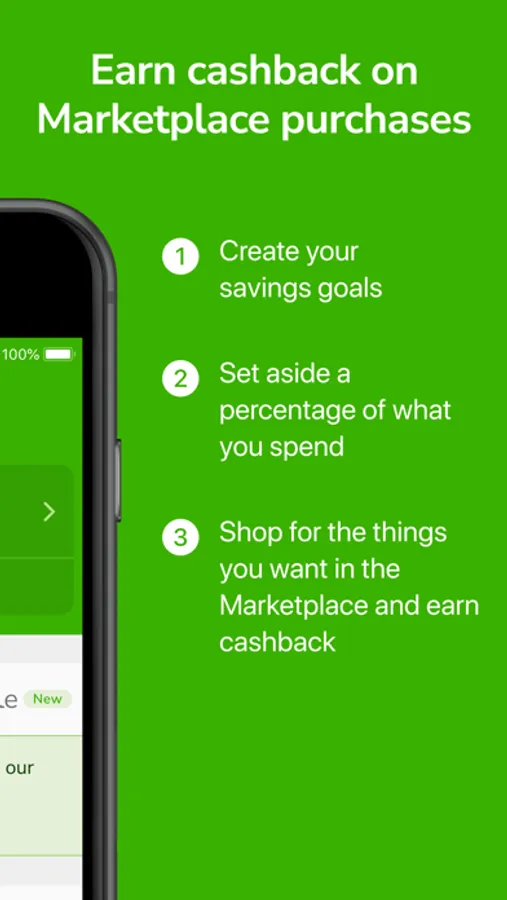

2. Create Your Savings Goals and Rules

Set up personalized Savings Goals and Savings Rules to save for what matters — whether it’s a trip, a car, groceries, or a future plan. Once set, Guac helps you save automatically through smart tipping and spending habits.

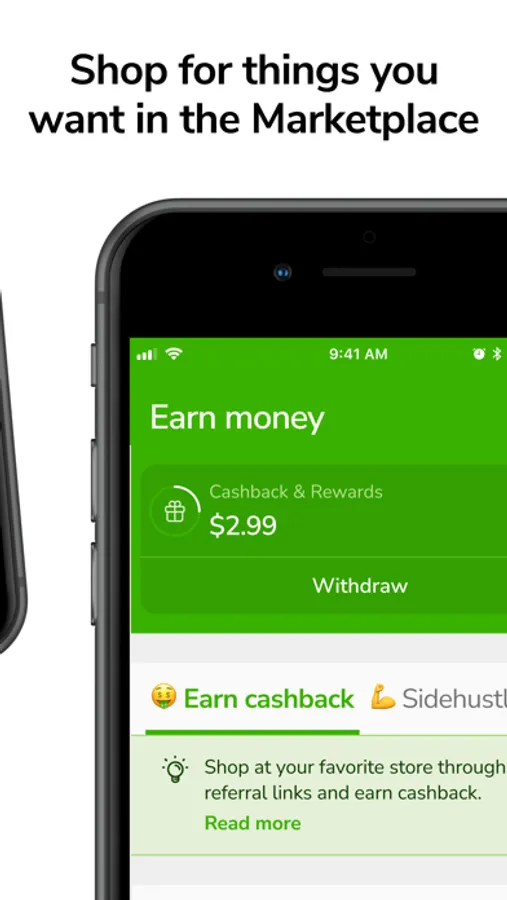

3. Accelerate Your Savings

Reach your goals faster by shopping in the Guac Marketplace to earn cash back or by exploring side hustles offered in the app. When you achieve your goal, you can easily use your saved funds for a purchase or transfer them to your connected checking account or card.

4. Move Money Seamlessly

Transfer funds easily between your Savings Goals and your checking account anytime — with just a few taps.

Important Information:

Guac is a financial technology company, not a bank. Guac is not FDIC-insured. Funds may be held for your benefit by First Federal Bank of Kansas City (FFBKC), Member FDIC.

Funds in custodial accounts may be eligible for FDIC insurance coverage on a pass-through basis, subject to regulatory requirements such as proper recordkeeping and ownership identification.

FDIC insurance only protects against the failure of an FDIC-insured bank; it does not protect against losses due to fraud, theft, market events, or Guac’s operations.

FDIC coverage is subject to standard limits — currently up to $250,000 per depositor, per insured bank, per account ownership category. Your total coverage depends on your relationship with the bank and any other accounts you maintain directly with the same institution.

Terms of Use: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

1. Sync Guac with Your Bank

Securely connect your bank checking account to synchronize your transactions. Guac makes saving simple and automatic — all within a secure environment you can trust.

2. Create Your Savings Goals and Rules

Set up personalized Savings Goals and Savings Rules to save for what matters — whether it’s a trip, a car, groceries, or a future plan. Once set, Guac helps you save automatically through smart tipping and spending habits.

3. Accelerate Your Savings

Reach your goals faster by shopping in the Guac Marketplace to earn cash back or by exploring side hustles offered in the app. When you achieve your goal, you can easily use your saved funds for a purchase or transfer them to your connected checking account or card.

4. Move Money Seamlessly

Transfer funds easily between your Savings Goals and your checking account anytime — with just a few taps.

Important Information:

Guac is a financial technology company, not a bank. Guac is not FDIC-insured. Funds may be held for your benefit by First Federal Bank of Kansas City (FFBKC), Member FDIC.

Funds in custodial accounts may be eligible for FDIC insurance coverage on a pass-through basis, subject to regulatory requirements such as proper recordkeeping and ownership identification.

FDIC insurance only protects against the failure of an FDIC-insured bank; it does not protect against losses due to fraud, theft, market events, or Guac’s operations.

FDIC coverage is subject to standard limits — currently up to $250,000 per depositor, per insured bank, per account ownership category. Your total coverage depends on your relationship with the bank and any other accounts you maintain directly with the same institution.

Terms of Use: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/