With this banking app, you can manage accounts, transfer funds, and pay bills securely. Includes features like KYC verification, investment options, and 24/7 access.

AppRecs review analysis

AppRecs rating 4.1. Trustworthiness 59 out of 100. Review manipulation risk 30 out of 100. Based on a review sample analyzed.

★★★★☆

4.1

AppRecs Rating

Ratings breakdown

5 star

81%

4 star

8%

3 star

5%

2 star

3%

1 star

2%

What to know

✓

High user satisfaction

81% of sampled ratings are 5 stars

✓

Authentic reviews

Natural distribution, no red flags

About Affinity

We are a fully digital financial institution committed to providing inclusive banking solutions for the majority.

Key Features:

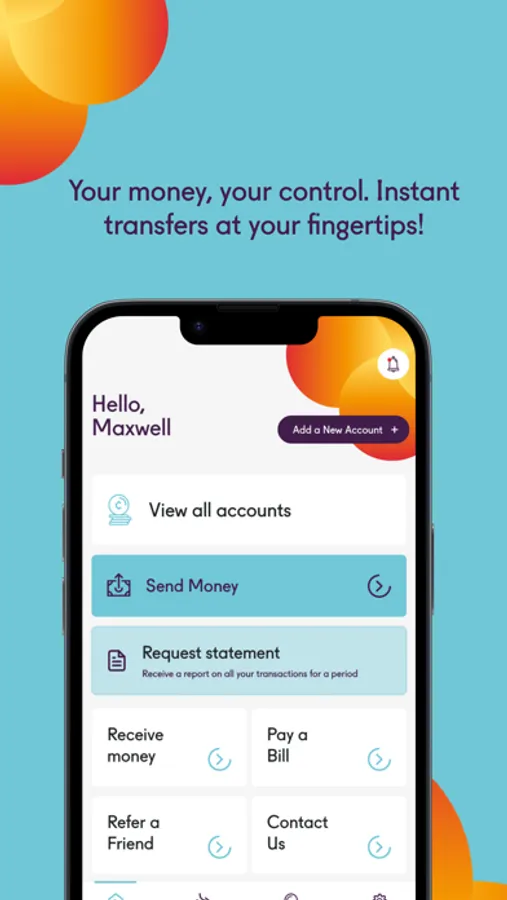

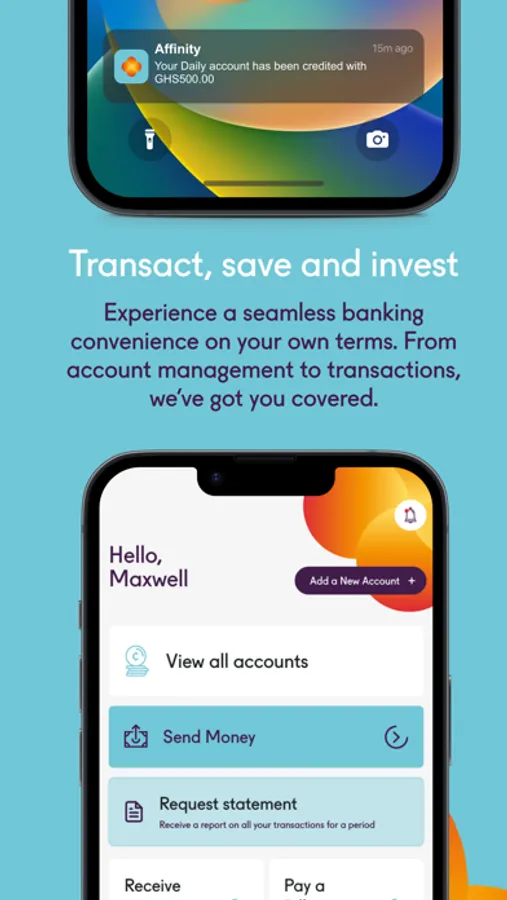

• User-friendly interface: the Affinity app is designed for everyone in mind, ensuring a seamless and intuitive banking experience.

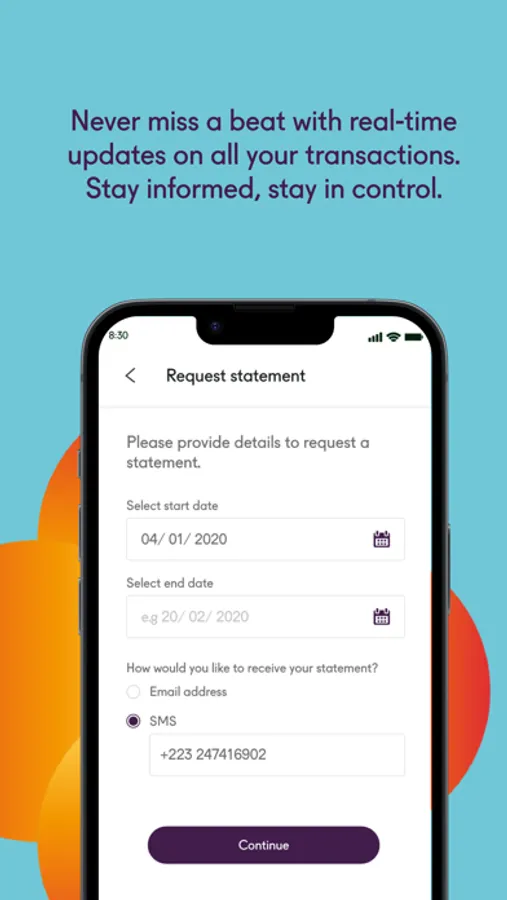

• 24/7 banking: enjoy round-the-clock access to banking services at an affordable cost, right from your fingertips.

• Licensed and regulated: rest assured, Affinity is licensed and regulated by the Bank of Ghana, prioritizing the security and trust of our users.

• Affordable products: accessible to all and enjoyed by thousands, Affinity offers affordable current, savings, and investment accounts, along with loan options.

• Account opening with KYC verification: join Affinity hassle-free with our streamlined KYC verification process.

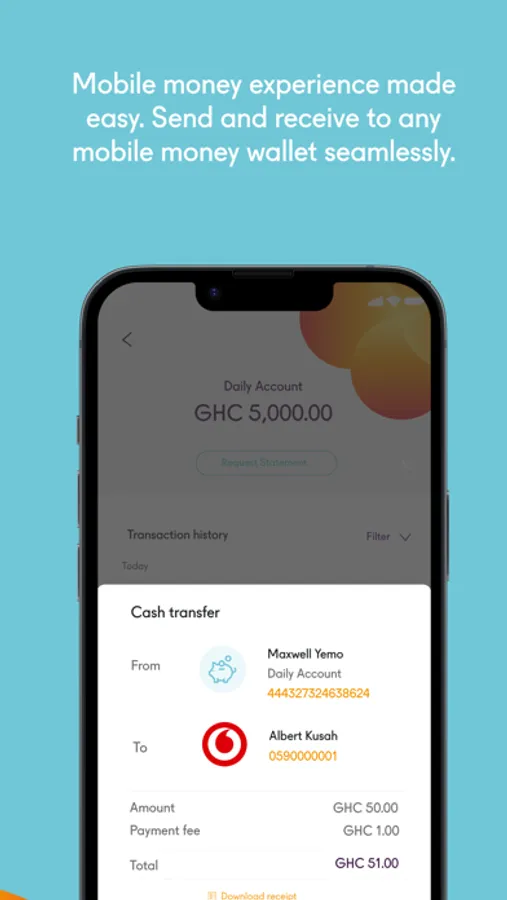

• Money transfers: seamlessly transfer funds between banks and mobile money accounts.

• Bill payments: settle your bills effortlessly using our secure platform.

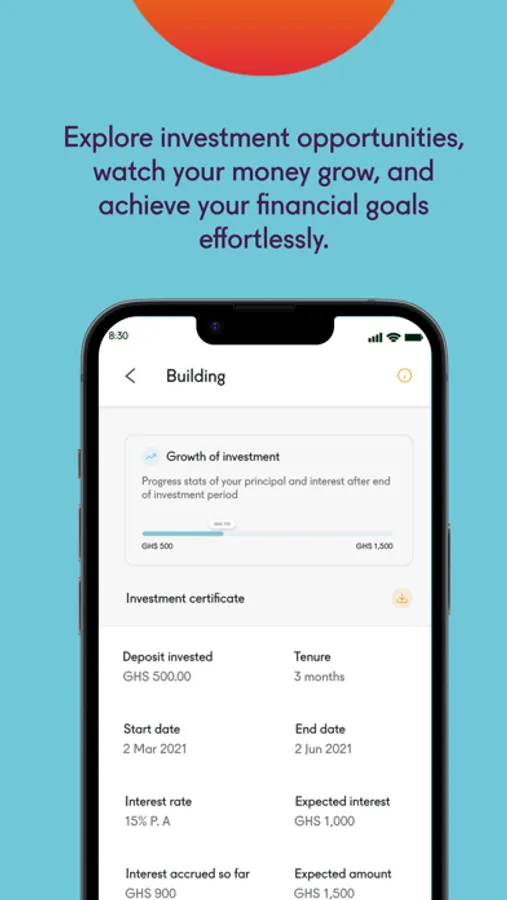

• Investments: explore diverse investment opportunities to grow your wealth.

• Support: our dedicated support team is ready to assist you whenever you need help.

Key Products:

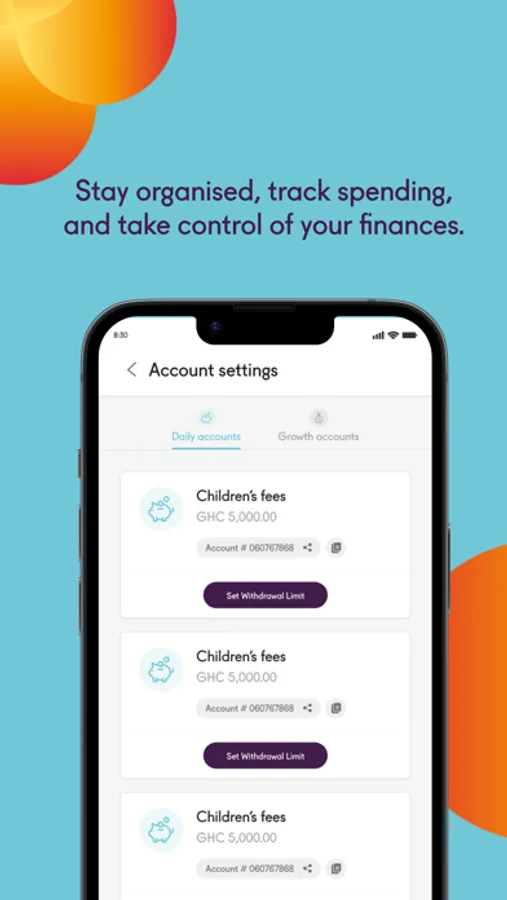

• Daily Account: designed for your everyday banking needs, it is transactional and provides easy access to your funds. It works like a regular current account but has no monthly fees, and it gets you up to 3% in interest. All you need is your valid Ghana Card for account opening.

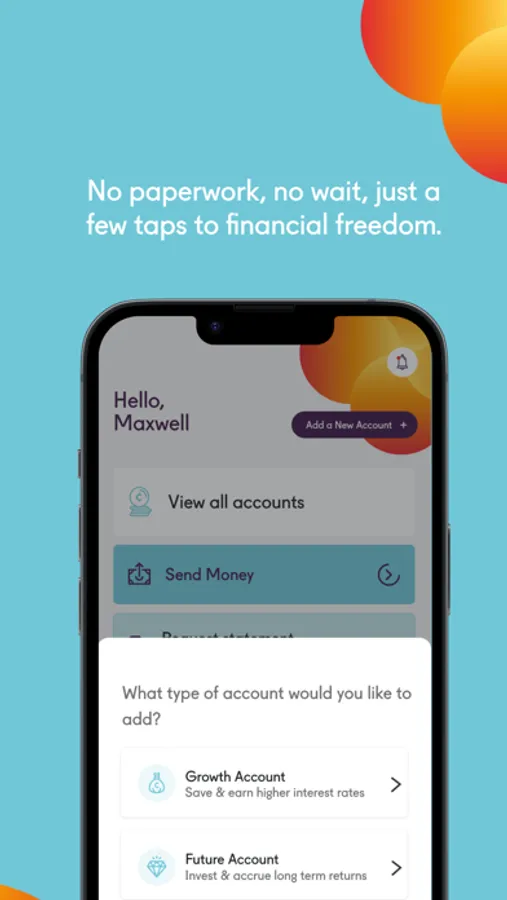

• Growth Account: perfect if you’re looking to grow your savings, this account offers competitive interest rates and additional benefits. You can open a Growth Account once you have a Daily Account with us.

• Future Account: fixed term deposit accounts that provide you with superior interest rates to enable you to build savings for future use. You can open a Future Account once you have a Daily Account with us.

• Affinity Loans: a number of options for your business or personal needs. Our loans require proof of income and may require collateral depending on the amount. You will need to have a Daily Account to apply for a loan.

Key Features:

• User-friendly interface: the Affinity app is designed for everyone in mind, ensuring a seamless and intuitive banking experience.

• 24/7 banking: enjoy round-the-clock access to banking services at an affordable cost, right from your fingertips.

• Licensed and regulated: rest assured, Affinity is licensed and regulated by the Bank of Ghana, prioritizing the security and trust of our users.

• Affordable products: accessible to all and enjoyed by thousands, Affinity offers affordable current, savings, and investment accounts, along with loan options.

• Account opening with KYC verification: join Affinity hassle-free with our streamlined KYC verification process.

• Money transfers: seamlessly transfer funds between banks and mobile money accounts.

• Bill payments: settle your bills effortlessly using our secure platform.

• Investments: explore diverse investment opportunities to grow your wealth.

• Support: our dedicated support team is ready to assist you whenever you need help.

Key Products:

• Daily Account: designed for your everyday banking needs, it is transactional and provides easy access to your funds. It works like a regular current account but has no monthly fees, and it gets you up to 3% in interest. All you need is your valid Ghana Card for account opening.

• Growth Account: perfect if you’re looking to grow your savings, this account offers competitive interest rates and additional benefits. You can open a Growth Account once you have a Daily Account with us.

• Future Account: fixed term deposit accounts that provide you with superior interest rates to enable you to build savings for future use. You can open a Future Account once you have a Daily Account with us.

• Affinity Loans: a number of options for your business or personal needs. Our loans require proof of income and may require collateral depending on the amount. You will need to have a Daily Account to apply for a loan.