myApex Card

Corserv

2.6 ★

store rating

Free

AppRecs review analysis

AppRecs rating 2.6. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.6

AppRecs Rating

Ratings breakdown

5 star

40%

4 star

0%

3 star

0%

2 star

0%

1 star

60%

What to know

⚠

Mixed user feedback

Average 2.6★ rating suggests room for improvement

About myApex Card

MANAGE YOUR ACCOUNT WITH EASE

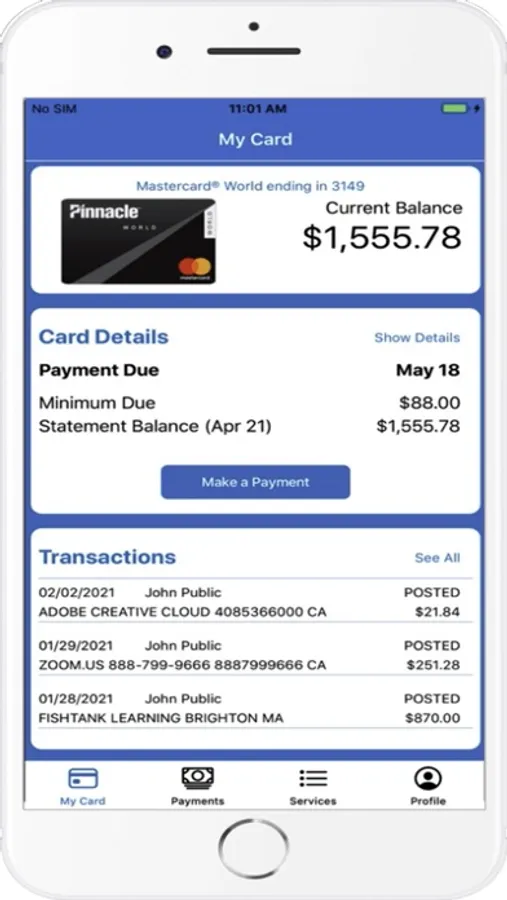

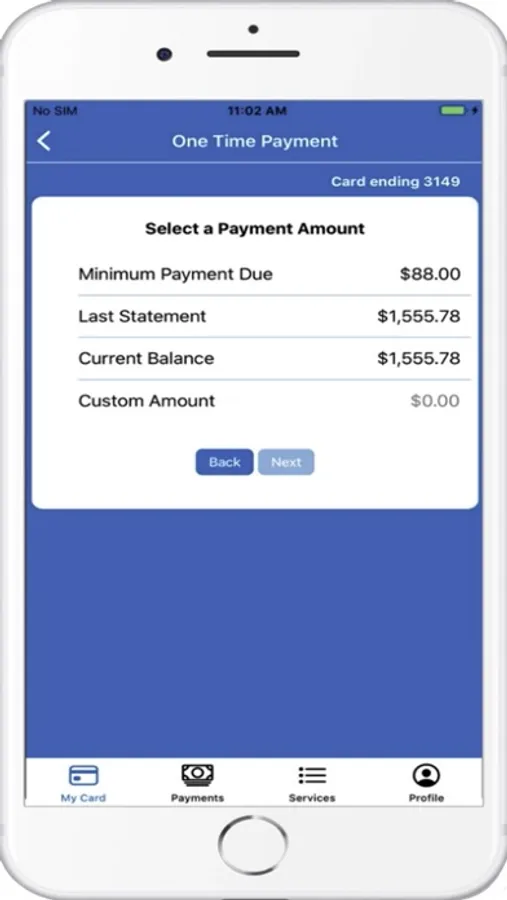

-Check your account balance and make a payment on your account from virtually anywhere.

-Rewards cardholders can check rewards balance and redeem via a statement credit or a direct deposit to your designated checking account.

-Freeze or unfreeze your credit card to control the purchases that go on your card.

STAY ON TOP OF YOUR SPENDING

-View your pending and posted transactions or open a PDF of your billing statement right from the app.

-Turn on AutoPay to pay your bill automatically from your bank account each month.

-Initiate a Balance Transfer.

ENJOY PEACE OF MIND WITH REAL-TIME ALERTS AND SPEND CONTROLS

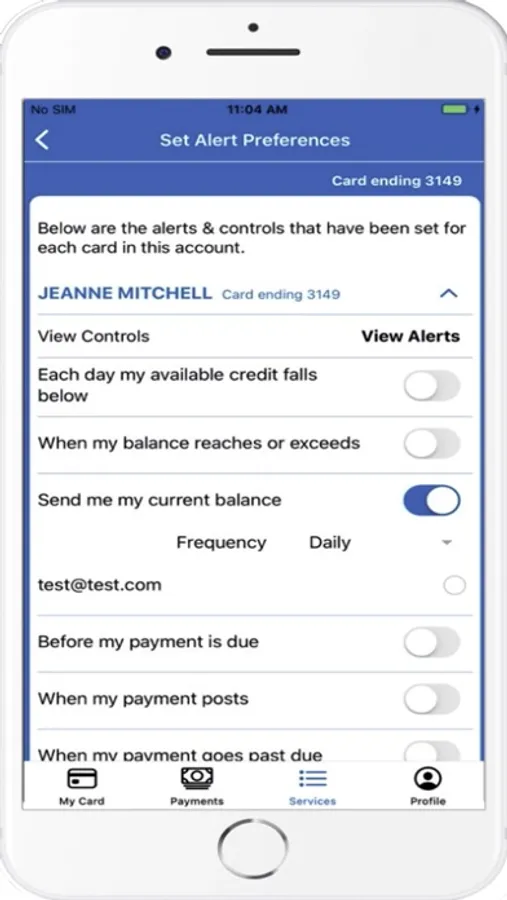

-Turn on purchase alerts to be notified when a purchase is made over a certain threshold so you can stay on top of daily spending and unexpected charges.

-Monitor potentially suspicious activity by receiving alerts when a purchase is made online, by phone, by mail, or outside of the United States.

-Never miss a payment with payment due alerts and notifications when your payment posts.

-Control spending by limiting the amount that can be spent per day or per transaction.

-And much more!

-Check your account balance and make a payment on your account from virtually anywhere.

-Rewards cardholders can check rewards balance and redeem via a statement credit or a direct deposit to your designated checking account.

-Freeze or unfreeze your credit card to control the purchases that go on your card.

STAY ON TOP OF YOUR SPENDING

-View your pending and posted transactions or open a PDF of your billing statement right from the app.

-Turn on AutoPay to pay your bill automatically from your bank account each month.

-Initiate a Balance Transfer.

ENJOY PEACE OF MIND WITH REAL-TIME ALERTS AND SPEND CONTROLS

-Turn on purchase alerts to be notified when a purchase is made over a certain threshold so you can stay on top of daily spending and unexpected charges.

-Monitor potentially suspicious activity by receiving alerts when a purchase is made online, by phone, by mail, or outside of the United States.

-Never miss a payment with payment due alerts and notifications when your payment posts.

-Control spending by limiting the amount that can be spent per day or per transaction.

-And much more!