SARS Mobile eFiling

South African Revenue Service

2.2 ★

store rating

Free

AppRecs review analysis

AppRecs rating 2.5. Trustworthiness 83 out of 100. Review manipulation risk 19 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.5

AppRecs Rating

Ratings breakdown

5 star

27%

4 star

0%

3 star

0%

2 star

9%

1 star

64%

What to know

✓

Low review manipulation risk

19% review manipulation risk

✓

Credible reviews

83% trustworthiness score from analyzed reviews

⚠

Mixed user feedback

Average 2.2★ rating suggests room for improvement

About SARS Mobile eFiling

Please note that the App is available for IOS version 10 to the latest.

The SARS eFiling App is an innovation from the South African Revenue Service (SARS) that will appeal to the new generation of mobile taxpayers. c, tablets or iPads and receive their assessment. The SARS eFiling App brings simple convenient, easy and secure eFiling to the palm of your hand, anytime, anywhere.

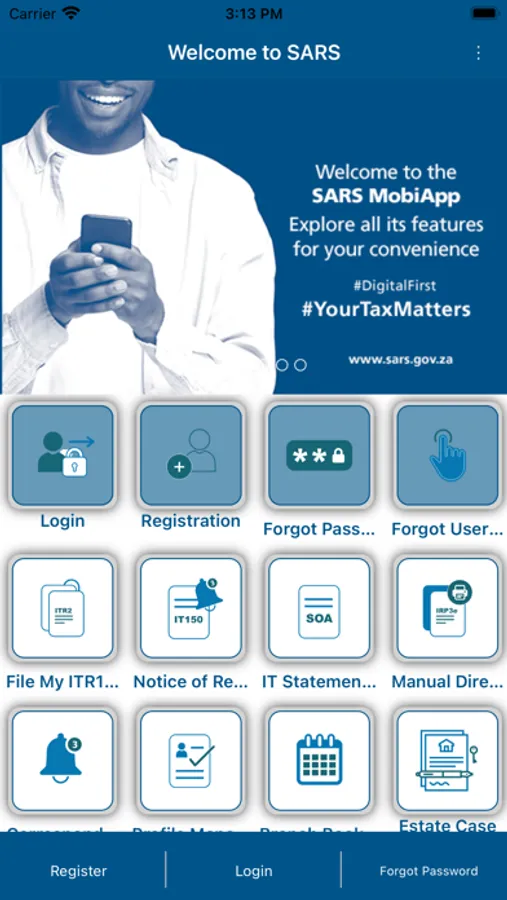

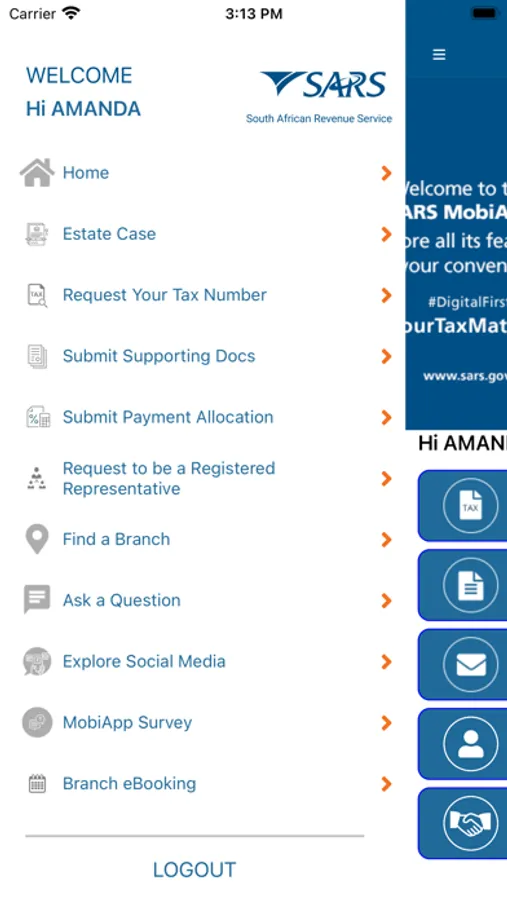

You can use the SARS eFiling App to:

•Register as an eFiler

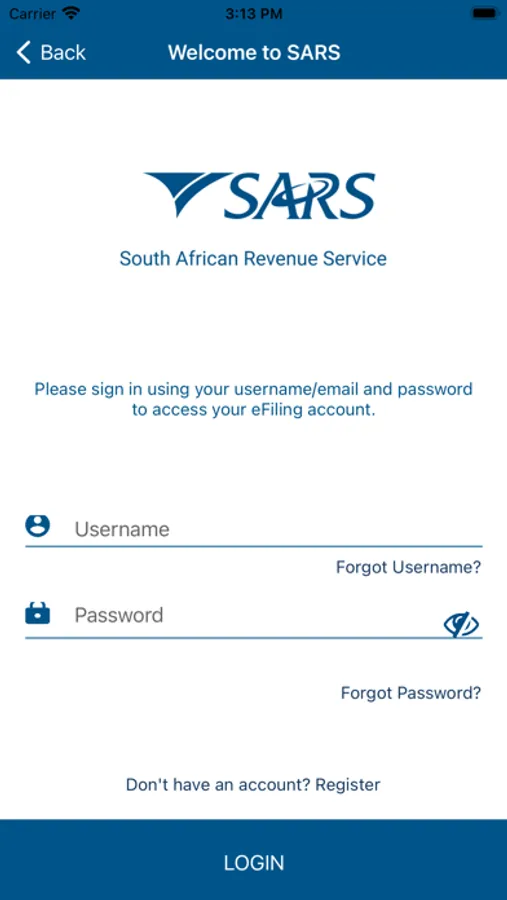

•Retrieve your username and/or password

•View, complete and submit your annual Income Tax Return (ITR12)

•Use the tax calculator to get an indication of your assessment outcome

•View the status of your return once submitted

•Upload supporting documents

•View a summary of your Notice of Assessment (ITA34)

•Request and view your Statement of Account (ITSA)

•Request Notice of Registration

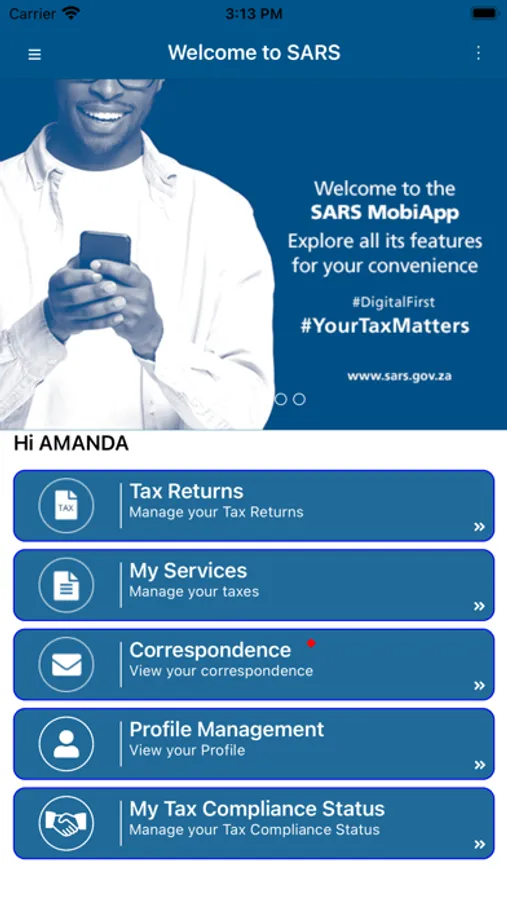

•View Correspondence

The SARS eFiling App is an innovation from the South African Revenue Service (SARS) that will appeal to the new generation of mobile taxpayers. c, tablets or iPads and receive their assessment. The SARS eFiling App brings simple convenient, easy and secure eFiling to the palm of your hand, anytime, anywhere.

You can use the SARS eFiling App to:

•Register as an eFiler

•Retrieve your username and/or password

•View, complete and submit your annual Income Tax Return (ITR12)

•Use the tax calculator to get an indication of your assessment outcome

•View the status of your return once submitted

•Upload supporting documents

•View a summary of your Notice of Assessment (ITA34)

•Request and view your Statement of Account (ITSA)

•Request Notice of Registration

•View Correspondence