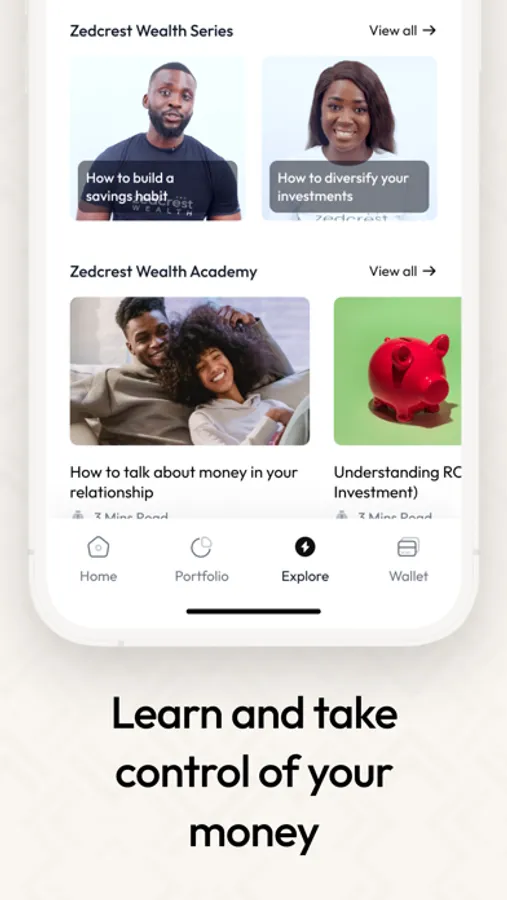

With this savings and investment app, you can automate deposits, set savings goals, and explore mutual funds and foreign currency options. Includes auto-invest features, financial news updates, and community sharing options.

AppRecs review analysis

AppRecs rating 4.4. Trustworthiness 75 out of 100. Review manipulation risk 32 out of 100. Based on a review sample analyzed.

★★★★☆

4.4

AppRecs Rating

Ratings breakdown

5 star

78%

4 star

6%

3 star

3%

2 star

2%

1 star

11%

What to know

✓

Credible reviews

75% trustworthiness score from analyzed reviews

✓

High user satisfaction

84% of sampled ratings are 4+ stars (4.4★ average)

✓

Authentic reviews

No red flags detected

About Zedcrest Wealth

Zedcrest Wealth is Nigeria's best savings and investment app, helping you grow your money while earning rewards on every savings and investment action.

As a SEC-licensed asset management firm, we ensure secure and profitable financial growth.

Here are our product offerings and key features:

1. Flexible savings: save without restrictions, withdraw anytime and earn competitive interest rates. Add your card for automated savings.

2. Target savings: Save for your big goals. Set a goal, decide on a timeline and set up auto-save to smash your targets!

3. Locked savings: Build discipline with strict, fixed deposits. You can't withdraw until the maturity date, no ifs or buts!

4. Auto-save & auto-reminders: Develop a strong savings culture with small consistent steps. Add your debit card and set up auto-save, or set up auto-reminders and we will send you automated push notifications or emails reminding you to save & invest.

5. Auto-invest: simplify your life, automate your investments and focus on other important things.

6. Mutual funds: explore short-term, low risk investments in local and global markets through our carefully curated funds.

7. Multi-currency wallets: explore local and global investment opportunities in Naira and Dollars.

8. Game Center: earn coins when you save and invest. Invite your friends to join the fun.

9. Weekly finance quiz: test your knowledge of personal finance, savings and investments with our weekly quiz

10. Communities & buddies: don't go alone, invite your friends on your money journey.

11. Financial insights: stay up-to-date with the latest Financial and Economic news.

12. Treasury Bills: Short term government backed instrument for steady capital appreciation, start with as little as N100,000 naira and earn returns within a year.

As a SEC-licensed asset management firm, we ensure secure and profitable financial growth.

Here are our product offerings and key features:

1. Flexible savings: save without restrictions, withdraw anytime and earn competitive interest rates. Add your card for automated savings.

2. Target savings: Save for your big goals. Set a goal, decide on a timeline and set up auto-save to smash your targets!

3. Locked savings: Build discipline with strict, fixed deposits. You can't withdraw until the maturity date, no ifs or buts!

4. Auto-save & auto-reminders: Develop a strong savings culture with small consistent steps. Add your debit card and set up auto-save, or set up auto-reminders and we will send you automated push notifications or emails reminding you to save & invest.

5. Auto-invest: simplify your life, automate your investments and focus on other important things.

6. Mutual funds: explore short-term, low risk investments in local and global markets through our carefully curated funds.

7. Multi-currency wallets: explore local and global investment opportunities in Naira and Dollars.

8. Game Center: earn coins when you save and invest. Invite your friends to join the fun.

9. Weekly finance quiz: test your knowledge of personal finance, savings and investments with our weekly quiz

10. Communities & buddies: don't go alone, invite your friends on your money journey.

11. Financial insights: stay up-to-date with the latest Financial and Economic news.

12. Treasury Bills: Short term government backed instrument for steady capital appreciation, start with as little as N100,000 naira and earn returns within a year.