About B4Tax Reverse Tax Witheld Calc

AUSTRALIA'S #1 REVERSE PAYROLL TAX CALCULATOR

Now requires a subscription to access all features — includes a 7-day free trial.

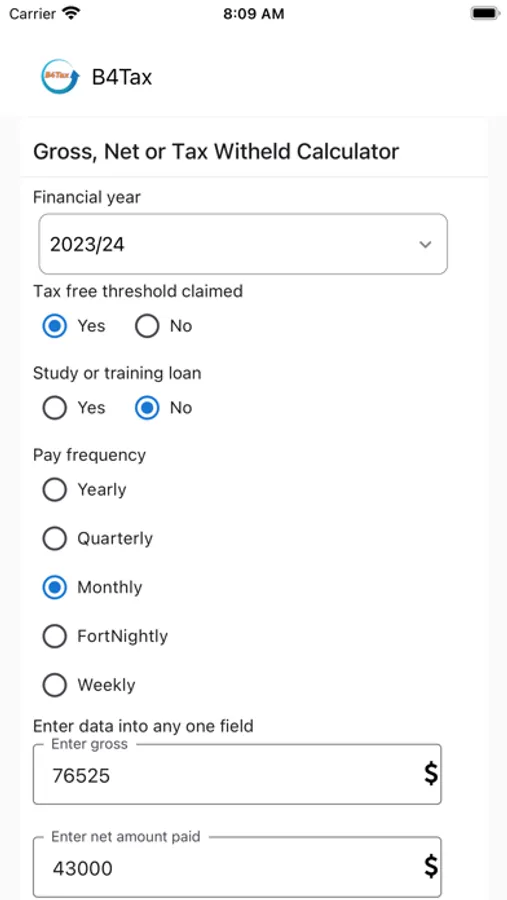

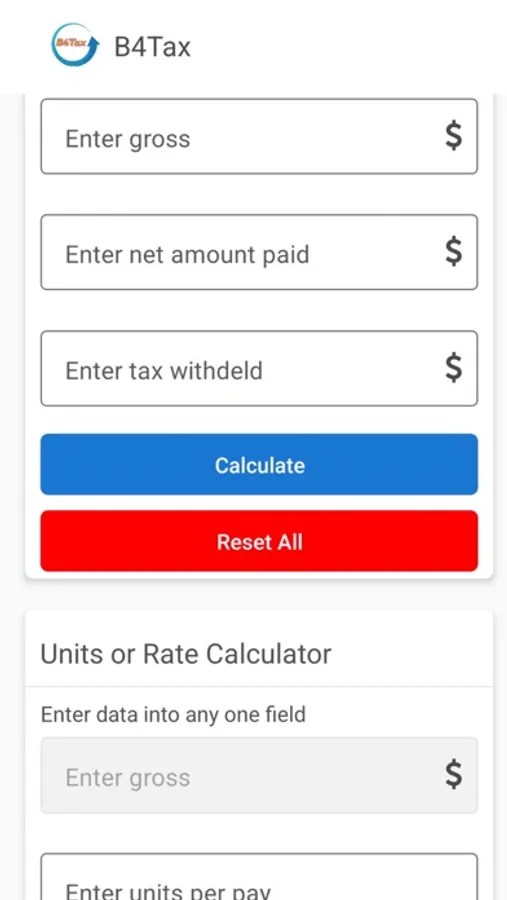

Calculate your Gross Pay for any pay cycle, based on your Net Pay — by working in reverse!

There are numerous tax-withheld calculators available on the web and in the App stores. None of them work in reverse. These calculators calculate the net wage based upon already knowing what the gross wage is.

B4Tax turns the regular PAYG calculator on its head. It works in reverse — from Net to Gross — including tax withheld, super, and more.

Now with Subscription Access

All existing features of the app are now part of the Premium plan, available via a monthly subscription.

* Start with a 7-day free trial

* Cancel anytime before the trial ends to avoid being charged

* Subscription auto-renews unless canceled

Why B4Tax?

Forget the hassle of manual reverse tax calculations. B4Tax calculates gross pay from net pay with ease — no more endless guesswork or spreadsheets.

Works backwards unlike other Tax Withheld calculators

B4Tax is unique. It calculates gross wage, tax withheld, super & hourly rate — from Net Pay. No other payroll tax calculator app for Australians does this!

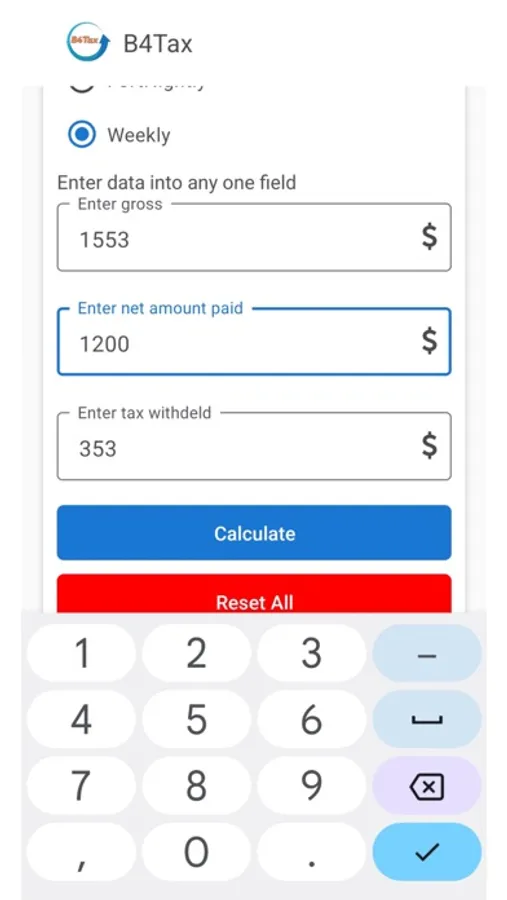

Get your answer in just a couple of taps

Answer a few basic questions about the employee’s net wage and get the gross pay in seconds. Simple!

Harmonious addition to your payroll system

Integrate B4Tax into your business’ payroll process. Seamlessly fits into your current operations, making it indispensable.

A real time-saver

Manual net-to-gross calculations are a thing of the past. B4Tax gives you accurate answers in seconds.

Adapts to Tax Changes

B4Tax stays up to date with the latest ATO tax rates — changes are updated automatically in the backend.

Features (Included with Subscription)

* Calculates Gross Wage and Tax Withheld from Net Wage

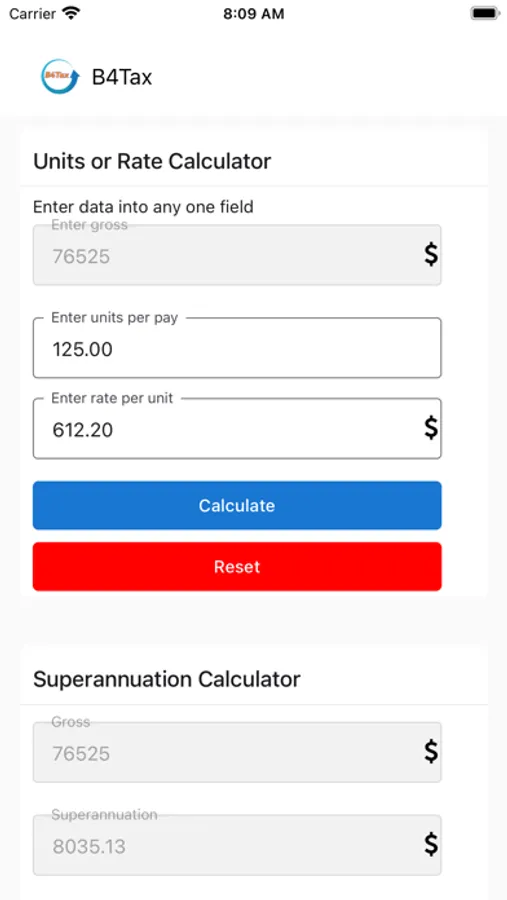

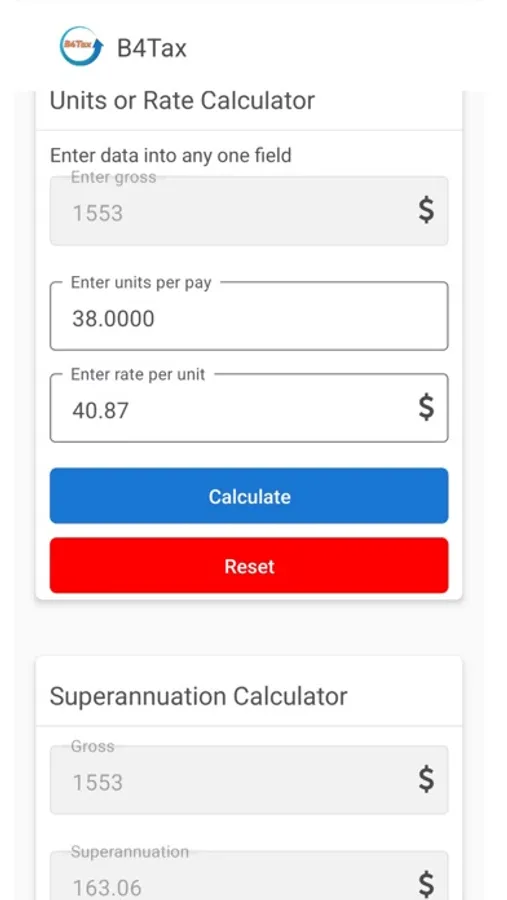

* Enter rate of pay → app calculates hours worked

* Calculates Superannuation payable

* Supports forward and reverse wage calculations (Net ↔ Gross)

Benefits

* Save time — no more manual reverse calculations

* Eliminate distractions — no switching back and forth to spreadsheets

* Solve gross wage puzzles on the spot — employers get quick answers

* Choose the year — works with current or previous tax years

Subscription Details

* Access to B4Tax requires a Monthly Subscription

* Try for free with a 7-day trial

* Cancel any time before trial ends to avoid being charged

* Manage or cancel your subscription via Apple ID settings

Try B4Tax Today — Simplify Your Payroll Process!

Terms of Use: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

Now requires a subscription to access all features — includes a 7-day free trial.

Calculate your Gross Pay for any pay cycle, based on your Net Pay — by working in reverse!

There are numerous tax-withheld calculators available on the web and in the App stores. None of them work in reverse. These calculators calculate the net wage based upon already knowing what the gross wage is.

B4Tax turns the regular PAYG calculator on its head. It works in reverse — from Net to Gross — including tax withheld, super, and more.

Now with Subscription Access

All existing features of the app are now part of the Premium plan, available via a monthly subscription.

* Start with a 7-day free trial

* Cancel anytime before the trial ends to avoid being charged

* Subscription auto-renews unless canceled

Why B4Tax?

Forget the hassle of manual reverse tax calculations. B4Tax calculates gross pay from net pay with ease — no more endless guesswork or spreadsheets.

Works backwards unlike other Tax Withheld calculators

B4Tax is unique. It calculates gross wage, tax withheld, super & hourly rate — from Net Pay. No other payroll tax calculator app for Australians does this!

Get your answer in just a couple of taps

Answer a few basic questions about the employee’s net wage and get the gross pay in seconds. Simple!

Harmonious addition to your payroll system

Integrate B4Tax into your business’ payroll process. Seamlessly fits into your current operations, making it indispensable.

A real time-saver

Manual net-to-gross calculations are a thing of the past. B4Tax gives you accurate answers in seconds.

Adapts to Tax Changes

B4Tax stays up to date with the latest ATO tax rates — changes are updated automatically in the backend.

Features (Included with Subscription)

* Calculates Gross Wage and Tax Withheld from Net Wage

* Enter rate of pay → app calculates hours worked

* Calculates Superannuation payable

* Supports forward and reverse wage calculations (Net ↔ Gross)

Benefits

* Save time — no more manual reverse calculations

* Eliminate distractions — no switching back and forth to spreadsheets

* Solve gross wage puzzles on the spot — employers get quick answers

* Choose the year — works with current or previous tax years

Subscription Details

* Access to B4Tax requires a Monthly Subscription

* Try for free with a 7-day trial

* Cancel any time before trial ends to avoid being charged

* Manage or cancel your subscription via Apple ID settings

Try B4Tax Today — Simplify Your Payroll Process!

Terms of Use: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/