DownPay: Spending & Debts

Life Utility Apps, LLC

4.9 ★

store rating

Free

In this financial management app, you can track debts, monitor spending, and set savings goals. Includes debt management tools, spending categorization, and savings tracking features.

AppRecs review analysis

AppRecs rating 4.7. Trustworthiness 72 out of 100. Review manipulation risk 25 out of 100. Based on a review sample analyzed.

★★★★☆

4.7

AppRecs Rating

Ratings breakdown

5 star

92%

4 star

6%

3 star

0%

2 star

0%

1 star

2%

What to know

✓

Low review manipulation risk

25% review manipulation risk

✓

Credible reviews

72% trustworthiness score from analyzed reviews

✓

High user satisfaction

92% of sampled ratings are 5 stars

About DownPay: Spending & Debts

Introducing DownPay: Your Ultimate Debt, Spending, and Savings Goal for Financial Planning App

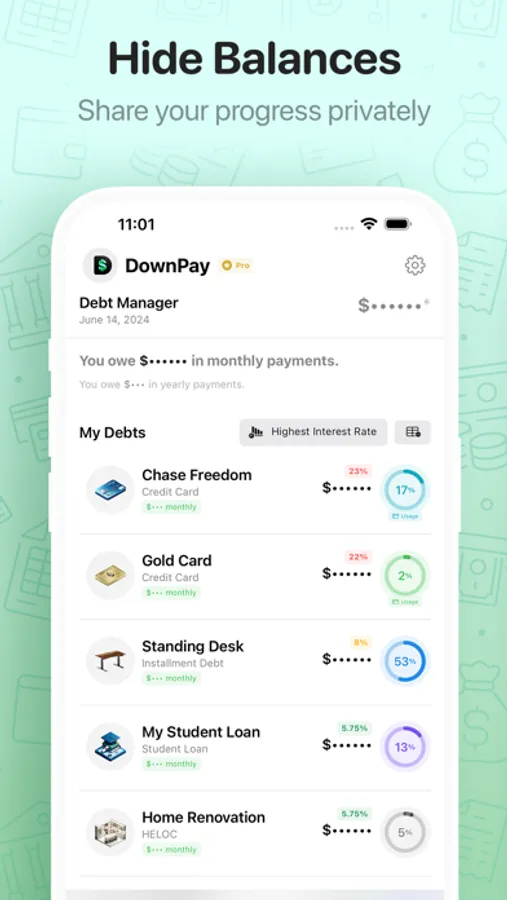

DownPay offers robust financial tools, transforming how you handle and visualize your finances. DownPay provides powerful manual tracking for your Spending, Debts, Savings Goals, and more.

Key Features:

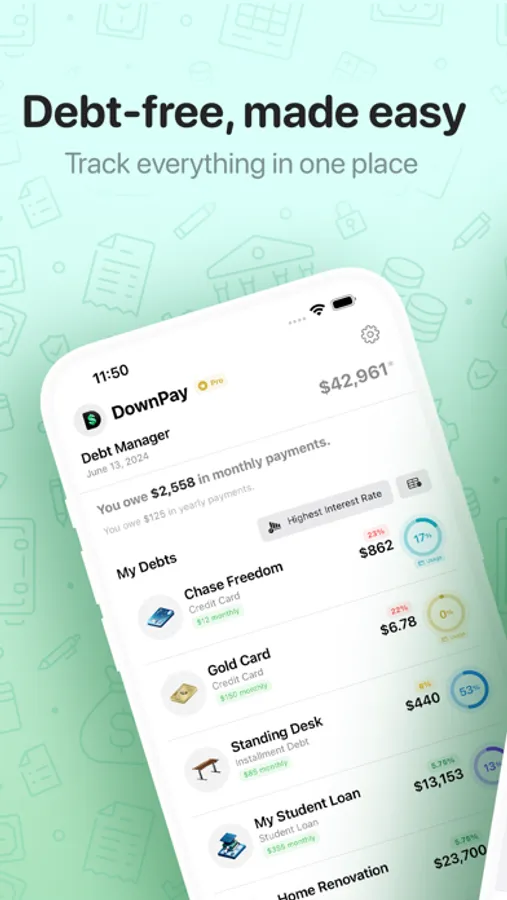

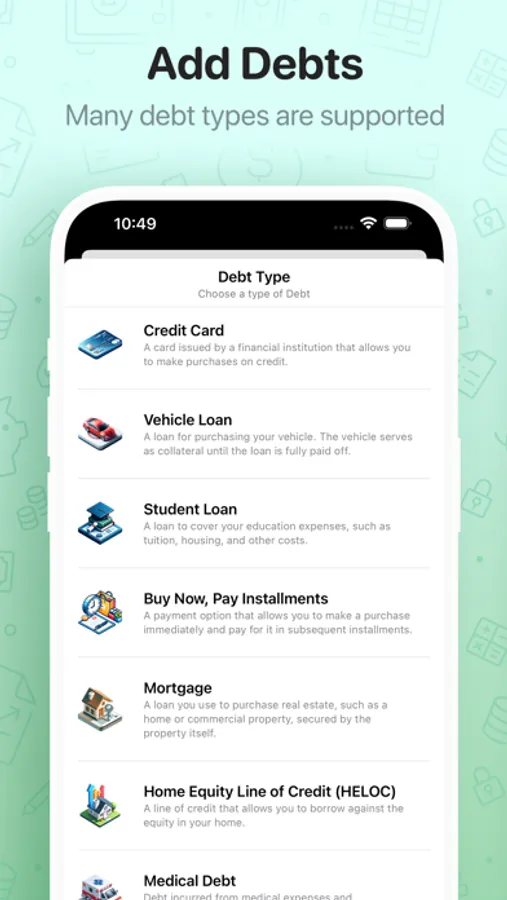

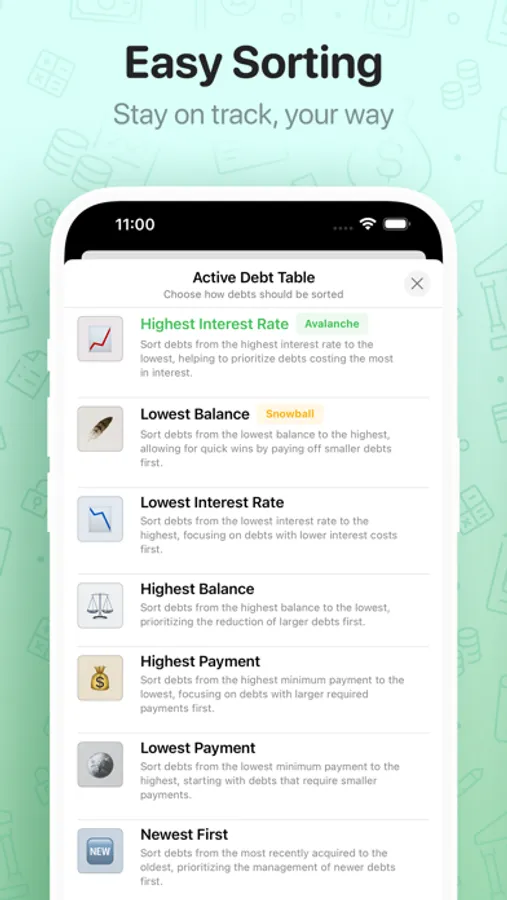

1. Advanced Debts & Loans Manager:

- Manage all types of debt in one place, including credit cards, student loans, auto loans, and mortgages.

- Easily add and track debts, view detailed progress reports, and plan repayment with a user-friendly interface.

- Track loans you've given to friends and family through a unique, easy-to-use Lending Manager.

- Allocate your paychecks into your debts, making balance updates simple and quick

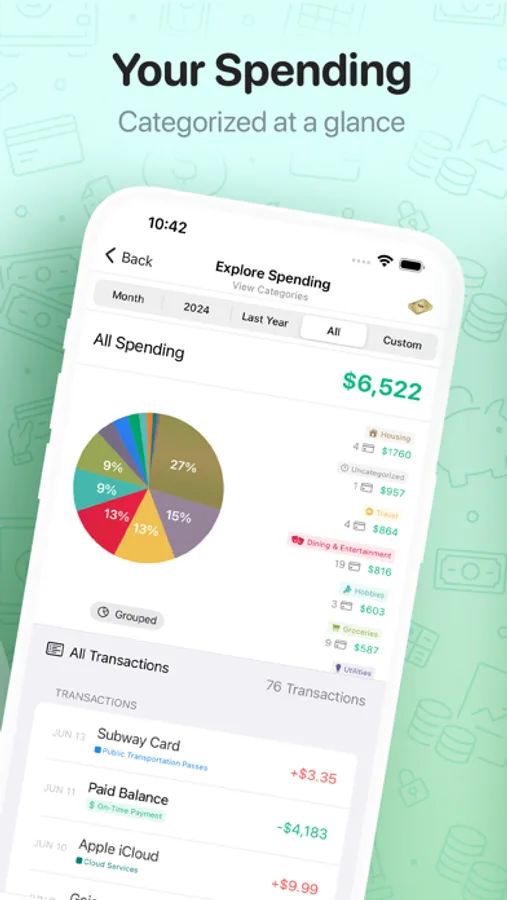

2. Spending Manager:

- Log your Credit Card spending across your cards with detailed categorization, metrics, and spending filtering.

- Link your transactions to thousands of apps, merchants, and services, with spending metrics available for each merchant.

- Categorize transactions and view total spending amounts by category.

- Transactions are linked to credit cards and can be edited or deleted easily.

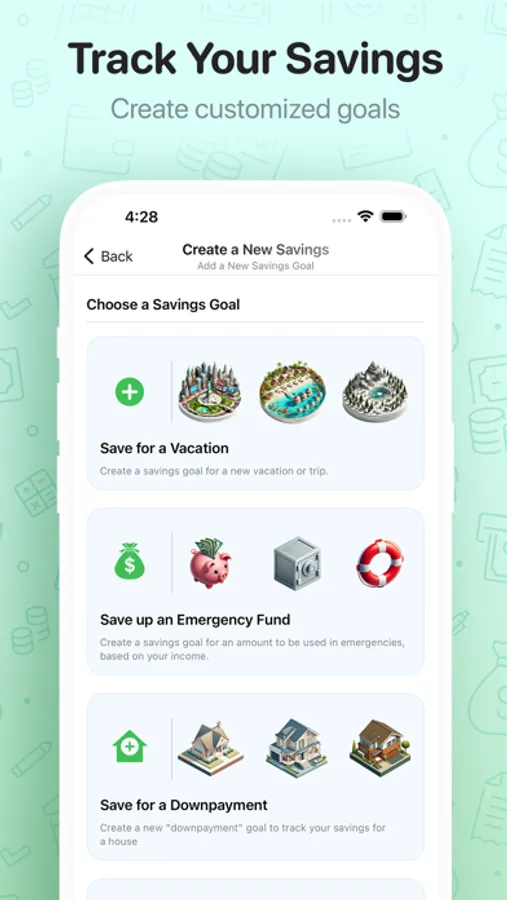

3. Enhanced Savings Tracker:

- Set and track savings goals for major purchases such as a downpayment on a house or a new car, with the ability to link savings to specific financial targets.

- Monitor various funding sources and see how close you are to reaching your goals through a visual, intuitive dashboard.

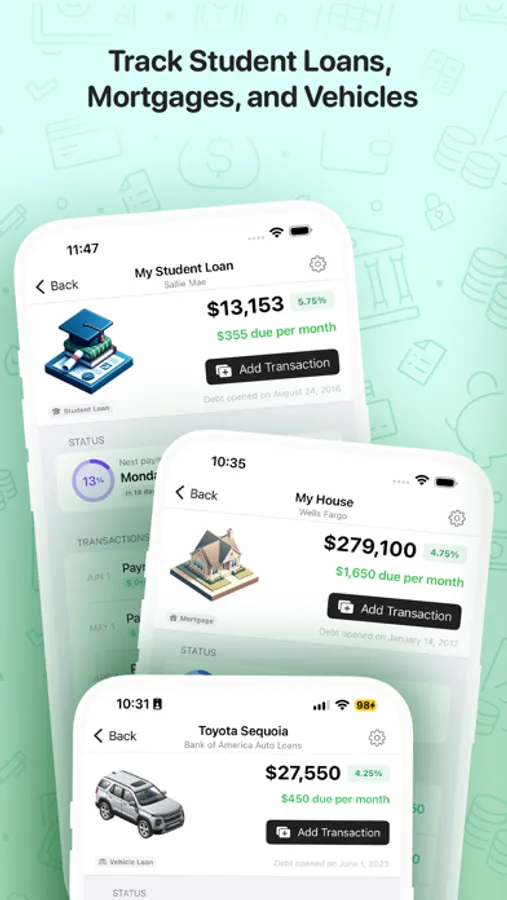

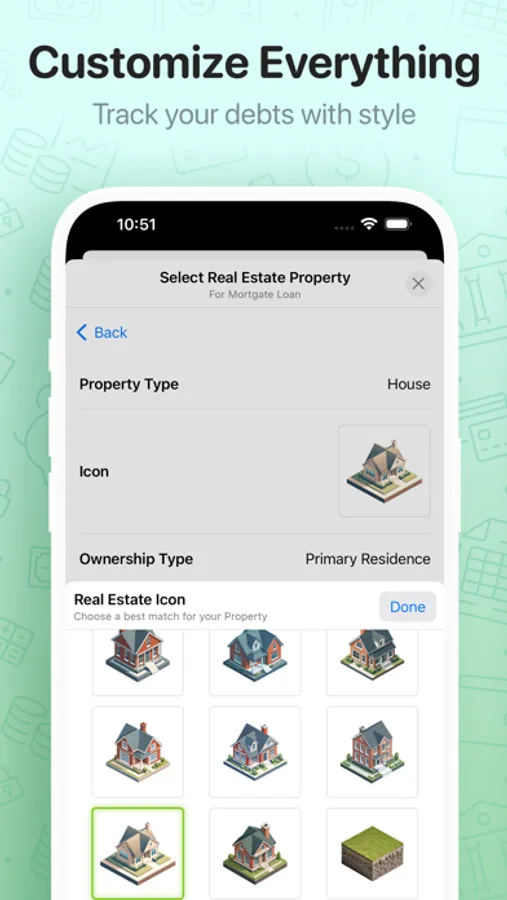

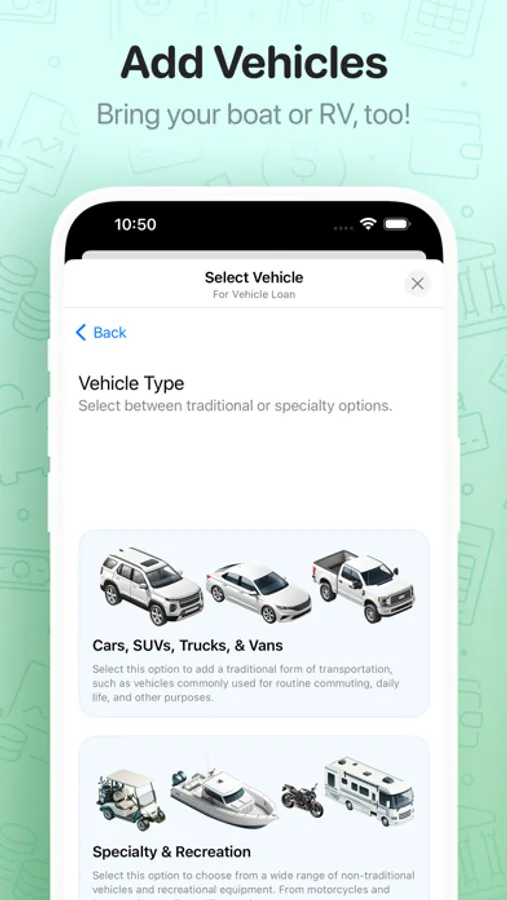

4. Asset-Linked Debts:

- Link each debt to specific assets like vehicles, real estate, or educational degrees for a comprehensive view of your financial commitments.

- This unique feature allows you to see the real impact of your debts on the assets they are financing, enhancing your financial planning capabilities.

5. Learning & Financial Tools:

- Dive into over 80 finance-related topics to enhance your financial literacy.

- Utilize embedded calculators for emergency funds, converting hourly wages to salary, compound interest estimations, and more to assist in your financial decision-making.

All your data is private and stored only on your device & backed up to iCloud if enabled for your device. DownPay has no servers and collects no data; There is no account or signup, all financial information is entered manually, and there is no banking login or synchronization to protect your privacy.

Why Choose DownPay?

DownPay is tailored for those seeking clarity and control over their debts, spending, savings, and financial goals. With our Debt and Spending Managers, and expanded savings functionalities, managing various debts and financial targets becomes as straightforward as planning your savings. Whether you're aiming to reduce debt, save for future investments, or understand the financial implications of your decisions, DownPay is your go-to app for navigating your financial landscape.

Empower your financial journey with DownPay today!

Please see the Terms of Use (EULA) at this link: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

Our Privacy Policy is located here: https://lifeutilityapps.com/privacy

DownPay offers robust financial tools, transforming how you handle and visualize your finances. DownPay provides powerful manual tracking for your Spending, Debts, Savings Goals, and more.

Key Features:

1. Advanced Debts & Loans Manager:

- Manage all types of debt in one place, including credit cards, student loans, auto loans, and mortgages.

- Easily add and track debts, view detailed progress reports, and plan repayment with a user-friendly interface.

- Track loans you've given to friends and family through a unique, easy-to-use Lending Manager.

- Allocate your paychecks into your debts, making balance updates simple and quick

2. Spending Manager:

- Log your Credit Card spending across your cards with detailed categorization, metrics, and spending filtering.

- Link your transactions to thousands of apps, merchants, and services, with spending metrics available for each merchant.

- Categorize transactions and view total spending amounts by category.

- Transactions are linked to credit cards and can be edited or deleted easily.

3. Enhanced Savings Tracker:

- Set and track savings goals for major purchases such as a downpayment on a house or a new car, with the ability to link savings to specific financial targets.

- Monitor various funding sources and see how close you are to reaching your goals through a visual, intuitive dashboard.

4. Asset-Linked Debts:

- Link each debt to specific assets like vehicles, real estate, or educational degrees for a comprehensive view of your financial commitments.

- This unique feature allows you to see the real impact of your debts on the assets they are financing, enhancing your financial planning capabilities.

5. Learning & Financial Tools:

- Dive into over 80 finance-related topics to enhance your financial literacy.

- Utilize embedded calculators for emergency funds, converting hourly wages to salary, compound interest estimations, and more to assist in your financial decision-making.

All your data is private and stored only on your device & backed up to iCloud if enabled for your device. DownPay has no servers and collects no data; There is no account or signup, all financial information is entered manually, and there is no banking login or synchronization to protect your privacy.

Why Choose DownPay?

DownPay is tailored for those seeking clarity and control over their debts, spending, savings, and financial goals. With our Debt and Spending Managers, and expanded savings functionalities, managing various debts and financial targets becomes as straightforward as planning your savings. Whether you're aiming to reduce debt, save for future investments, or understand the financial implications of your decisions, DownPay is your go-to app for navigating your financial landscape.

Empower your financial journey with DownPay today!

Please see the Terms of Use (EULA) at this link: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

Our Privacy Policy is located here: https://lifeutilityapps.com/privacy