Breakwater Federal CU

BREAKWATER FEDERAL CREDIT UNION

4.6 ★

store rating

Free

With this banking app, you can manage transactions, set alerts, make payments, and deposit checks. Includes account security features, transaction organization tools, and branch locator functions.

AppRecs review analysis

AppRecs rating 4.4. Trustworthiness 80 out of 100. Review manipulation risk 24 out of 100. Based on a review sample analyzed.

★★★★☆

4.4

AppRecs Rating

Ratings breakdown

5 star

82%

4 star

9%

3 star

3%

2 star

1%

1 star

5%

What to know

✓

Low review manipulation risk

24% review manipulation risk

✓

Credible reviews

80% trustworthiness score from analyzed reviews

✓

High user satisfaction

82% of sampled ratings are 5 stars

About Breakwater Federal CU

Breakwater Federal Credit Union is a mobile decision-support tool.

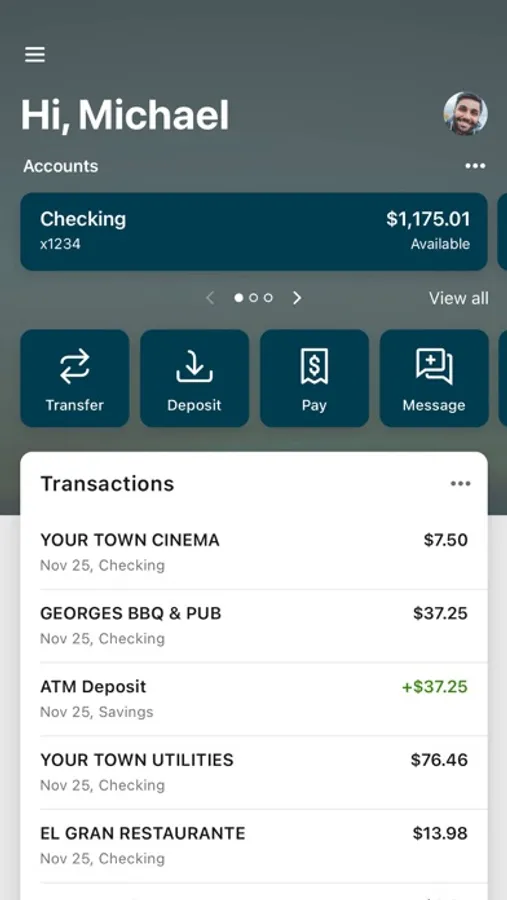

Breakwater Federal CU is your personal financial advocate. It’s fast, secure and makes life easier by empowering you with the tools you need to manage your finances.

Here’s what you can do with Breakwater Federal CU:

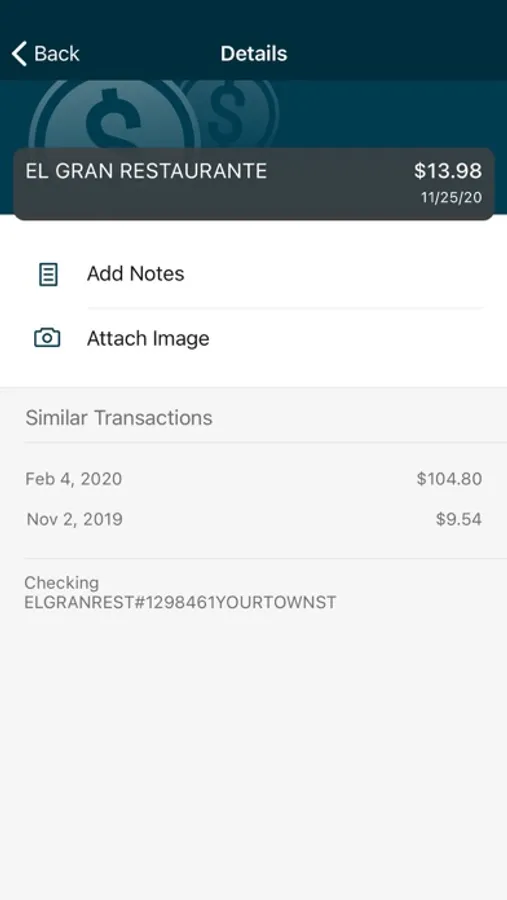

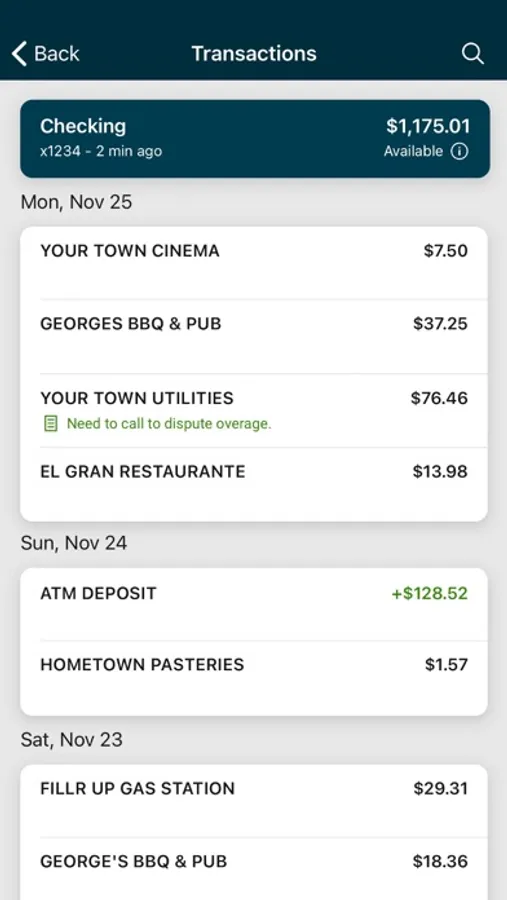

• Keep your transactions organized by allowing you to add tags, notes and photos of receipts and checks.

• Set up alerts so you know when your balance drops below a certain amount.

• Make Payments, whether you’re paying a company or a friend.

• Transfer money between your accounts.

• Deposit checks in a snap by taking a picture of the front and back.

• Reorder your debit card or turn it off if you’ve misplaced it.

• View and save your monthly statements.

• Find Branches and ATMs near you.

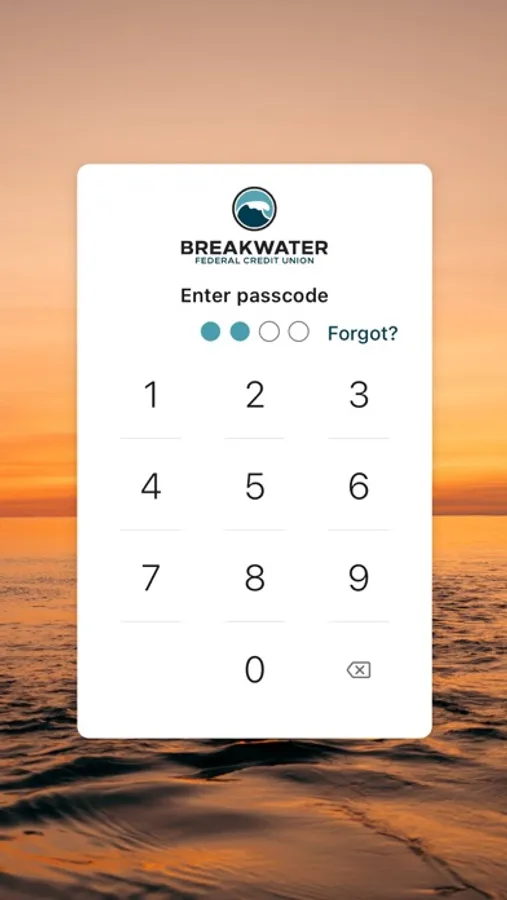

• Secure your account with a 4-digit passcode or biometric on support devices.

Breakwater Federal CU is your personal financial advocate. It’s fast, secure and makes life easier by empowering you with the tools you need to manage your finances.

Here’s what you can do with Breakwater Federal CU:

• Keep your transactions organized by allowing you to add tags, notes and photos of receipts and checks.

• Set up alerts so you know when your balance drops below a certain amount.

• Make Payments, whether you’re paying a company or a friend.

• Transfer money between your accounts.

• Deposit checks in a snap by taking a picture of the front and back.

• Reorder your debit card or turn it off if you’ve misplaced it.

• View and save your monthly statements.

• Find Branches and ATMs near you.

• Secure your account with a 4-digit passcode or biometric on support devices.