Lincoln Financial Mobile

Lincoln Financial Group

3.3 ★

store rating

Free

With this mobile app, you can manage your retirement account, submit claims, view ID cards, and access wellness tools. Includes secure account access, claim management, benefit overview, and financial planning tools.

AppRecs review analysis

AppRecs rating 2.6. Trustworthiness 67 out of 100. Review manipulation risk 23 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.6

AppRecs Rating

Ratings breakdown

5 star

52%

4 star

1%

3 star

3%

2 star

7%

1 star

37%

What to know

✓

Low review manipulation risk

23% review manipulation risk

✓

Authentic reviews

No red flags detected

⚠

High negative review ratio

43% of sampled ratings are 1–2 stars

About Lincoln Financial Mobile

Accessing your Lincoln account information from your favorite device is easier than ever on the Lincoln Financial Mobile app!

Our all-inclusive mobile app allows you manage your retirement plan, employee benefits, and wellness tools, all in one secure place. Safely access and adjust your retirement account, submit and manage claims, view dental ID cards, provide essential information to keep your claim on track, find a dentist, take advantage of financial wellness tools, and more!

Here are some key features:

Retirement plan

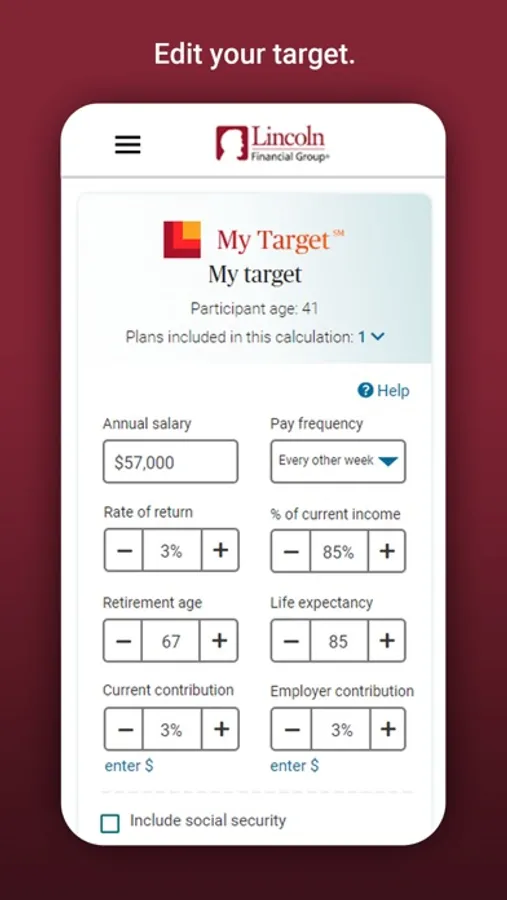

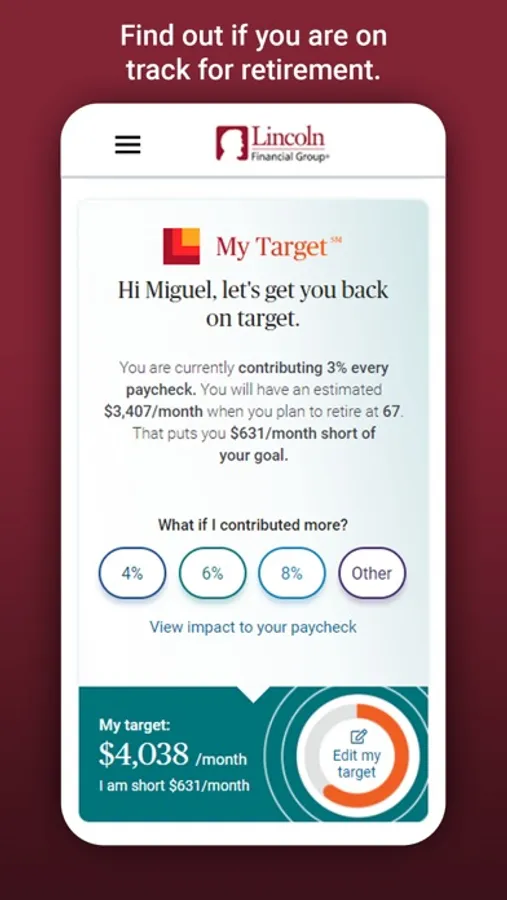

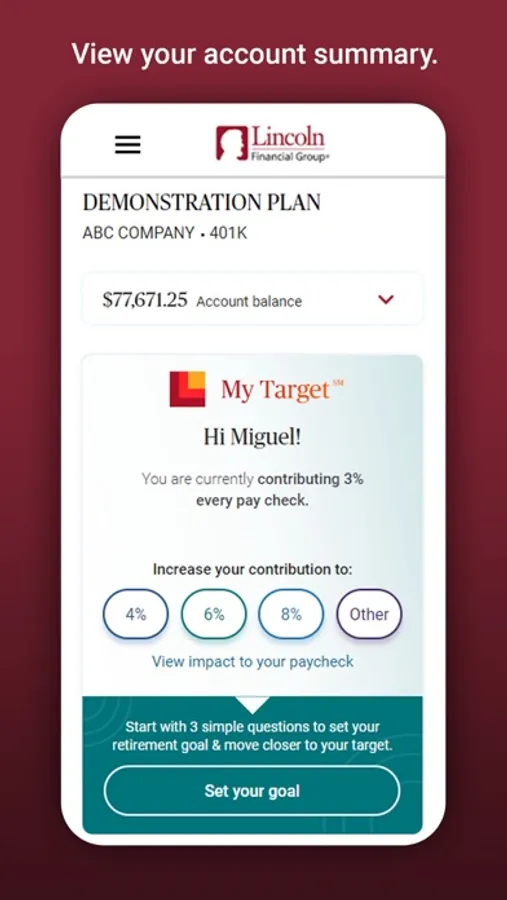

My TargetSM:

The My Target retirement estimator lets you see how your account balance may translate into monthly income after retirement. With Click2ContributeSM integration, it’s simple to increase contributions to help meet your savings goals.

Click2Contribute:

Click2Contribute makes it simple to increase your contribution rate by selecting one of three preset percentages. Even before you make a change, the contribution planner also shows how an increase may affect your paycheck.

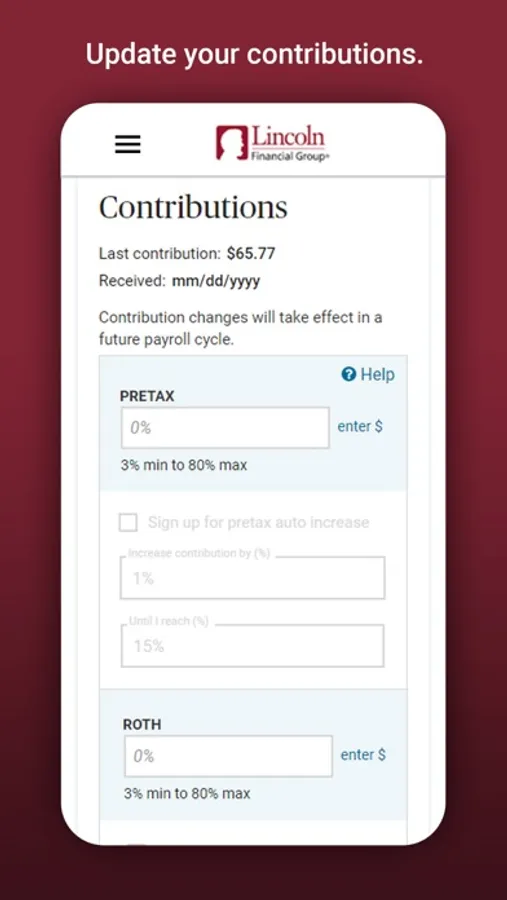

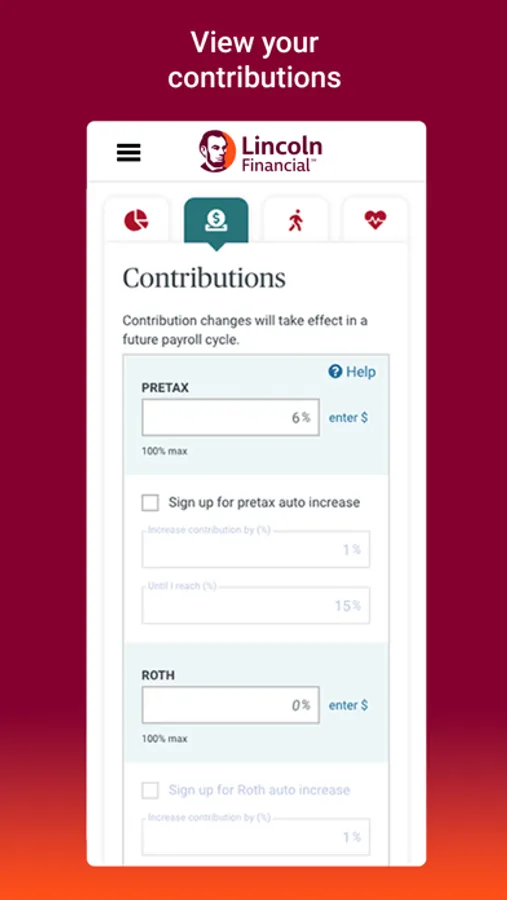

Contributions:

The Contributions tab lets you update deferral amounts and see a detailed breakdown of your year-to-date contributions. If you make Roth contributions, you’ll also see a lifetime cost basis versus earning breakdown.

Investments:

The Investments tab provides an interactive graph of your account balance over time.

My next steps:

This prioritizes actions on the road to retirement, like consolidating your assets or increasing your knowledge. (This feature may not be available for all plans.)

Employee benefits:

Everything you need to manage your benefits is in one place, letting you submit and manage a claim, download forms, upload documents and view payments. It’s also a convenient way to stay on top of administrative details like accessing your digital dental ID card and our network of dental providers.

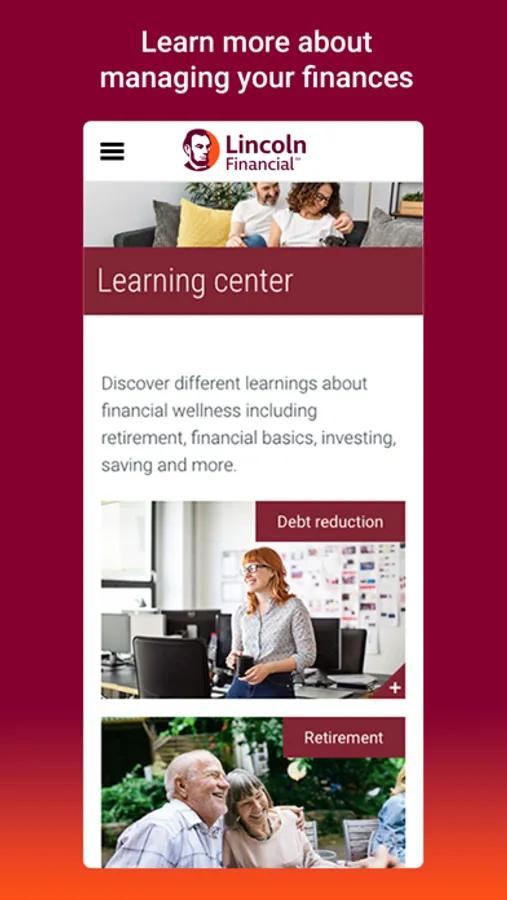

Financial wellness:

Our proprietary financial wellness solution provides tools and personalized steps to manage your financial life. From creating a budget, to building an emergency fund, to paying down debt, our easy-to-use online tool helps you turn information into action so you can focus on both short- and long-term goals, such as saving for retirement or providing protection for your loved ones.

Our all-inclusive mobile app allows you manage your retirement plan, employee benefits, and wellness tools, all in one secure place. Safely access and adjust your retirement account, submit and manage claims, view dental ID cards, provide essential information to keep your claim on track, find a dentist, take advantage of financial wellness tools, and more!

Here are some key features:

Retirement plan

My TargetSM:

The My Target retirement estimator lets you see how your account balance may translate into monthly income after retirement. With Click2ContributeSM integration, it’s simple to increase contributions to help meet your savings goals.

Click2Contribute:

Click2Contribute makes it simple to increase your contribution rate by selecting one of three preset percentages. Even before you make a change, the contribution planner also shows how an increase may affect your paycheck.

Contributions:

The Contributions tab lets you update deferral amounts and see a detailed breakdown of your year-to-date contributions. If you make Roth contributions, you’ll also see a lifetime cost basis versus earning breakdown.

Investments:

The Investments tab provides an interactive graph of your account balance over time.

My next steps:

This prioritizes actions on the road to retirement, like consolidating your assets or increasing your knowledge. (This feature may not be available for all plans.)

Employee benefits:

Everything you need to manage your benefits is in one place, letting you submit and manage a claim, download forms, upload documents and view payments. It’s also a convenient way to stay on top of administrative details like accessing your digital dental ID card and our network of dental providers.

Financial wellness:

Our proprietary financial wellness solution provides tools and personalized steps to manage your financial life. From creating a budget, to building an emergency fund, to paying down debt, our easy-to-use online tool helps you turn information into action so you can focus on both short- and long-term goals, such as saving for retirement or providing protection for your loved ones.